There’s been a lot of unknowns in the news lately, but one thing we’re sure is coming is a financial slow down. The coronavirus pandemic has caused hardships for not only local business owners, but many individuals who are currently out of a job. This lack of spending will have ripple effects in many industries, including the real estate market in Des Moines.

Many local investors in the multifamily housing market are nervous about whether or not tenants will be able to make rent payments during the upcoming economic downturn. Our market research team surveyed many local property owners to assess the current climate and project the commercial real estate trends we expect to see in the coming months. See how the commercial real estate market in Des Moines stacks up compared to national averages.

Insights From Des Moines Property Owners: The Current Multifamily Housing Market

The Katalyst Team sent a questionnaire the past two months asking questions about what local property owners experienced during the months of April and May. This data reflects how individuals may have been affected after COVID-19 precautions had been put into place, causing job losses and small businesses to shut their doors.

Are Renters Making Full Payments During Troubling Times?

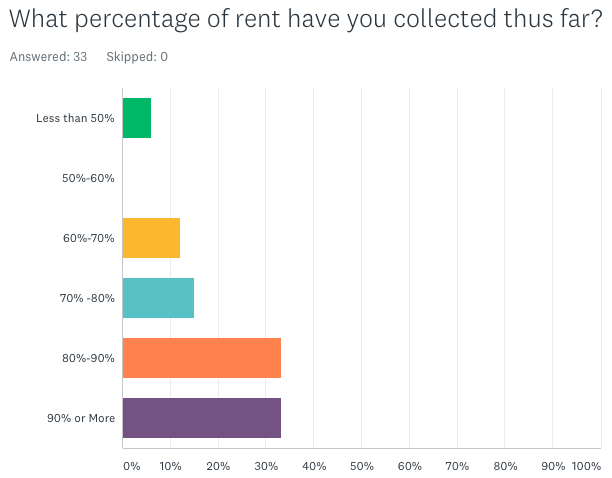

Our first question to gage how the commercial real estate market in Des Moines was holding up, asked if tenants had the ability to make full monthly rent payments or not. Our survey went out in mid April and again in mid May, giving property owners additional time to accumulate payments. The results showed 67% of respondents collected over 80% of rent payments, and only 6%, or two owners, earned less than 50% of April’s rent. Even though many owners in the multifamily housing market hadn’t collected full rental fees at the time, the results were actually much better than expected for such an abrupt turn in economic activity.

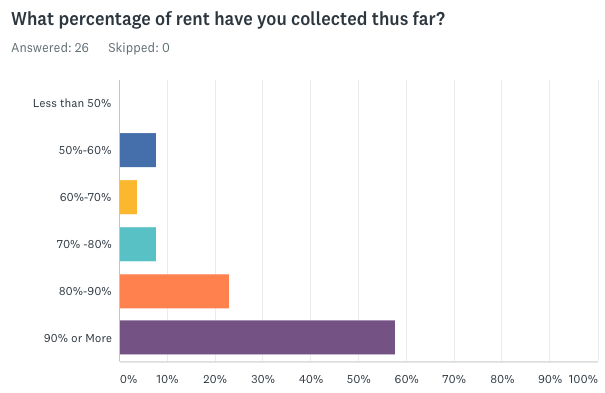

The feedback we received in May was even more positive. Even with the effects of this pandemic making an impact within the Des Moines community, most residents were able to make all or most of their rental payments, and no commercial property owners were collecting less than half of rental fees at that time.

How Does This Compare to The National Average?

According to our survey, over 90% of Iowa tenants paid the majority of their lease payments. In mid-April, almost 85% of renters across the nation had made full or partial payments, down only 5% from the year before, according to the numbers from the National Multifamily Housing Council. This slight drop provides a positive outlook for the multifamily housing market thus far. Similarly, about 88% of renters across the U.S. were able to make full or partial rental payments in May. This could be a sign of a more positive outlook than what was expected, but only time will tell. Our experts are anxious to see what the upcoming months will bring as some renters potentially remain unemployed or are forced to take pay cuts during this uncertain time.

Are Property Owners Offering Any Support During This Hardship?

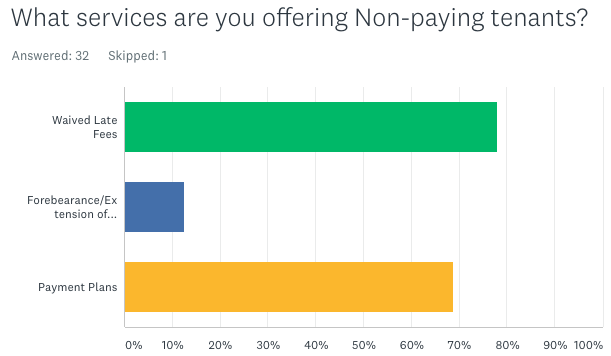

The second question in The Katalyst Team survey asked property owners in the April survey was if they’re offering additional services to accommodate tenants having a hard time making ends meet. The commercial real estate owners in Des Moines are showing compassion and offering waived late fees, extended leases and/or payment plans.

Predicting Commercial Real Estate Trends During an Economic Downturn

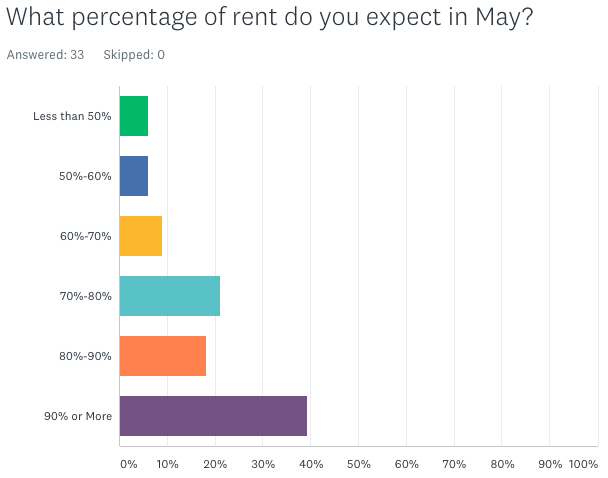

Our final question probed property owners asking how much they expect to collect in lease payments in the future. While we start to notice the effects of the global recession brought on by the COVID-19 crisis, many Des Moines property owners worry about accumulating their standard rent and the outlook of the multifamily housing market in the future.

While many of the local commercial property owners we surveyed expected less income in May, our new results showed that local residents are still making payments during these tough economic times. We remain hopeful that Iowa residents will remain above the national average throughout this crisis.

If you’re a commercial real estate owner in Iowa, we’d love to know how you have been affected during difficult economic times. Please fill out our survey for May results.

Experts Forecast How Multifamily Housing Market Will React to the Recession

While we’ll be watching the commercial real estate market in Des Moines closely, we’re also taking a look at the bigger picture and how rental property owners will be affected in the long-term with a recession seemingly on the horizon. The biggest commercial real estate trends we can predict during a recession are:

- Lower selling prices. With a potential of less competition in the multifamily housing market, owners looking to sell will earn less as prices for commercial properties drop.

- Vacancy concerns. Less cash flow among consumers could result in seeking cheaper living arrangements. This will especially put Class A, or primely located and luxurious properties at risk, while Class C properties, which are older in less desirable neighborhoods, could see more demand.

- Bad debt. If property owners aren’t collecting rent checks, it could affect their property’s net operating income and they may struggle to make mortgage payments.

- Demand to invest local. On a positive note, sometimes recessions can boost the local market. Large investors may pull their money out of risky stocks and choose to invest in real estate, which is more reliable.

Some experts predict this recession will not be as long and drawn out as the last recession back in 2008. Rather, we’ll have a brief and brutal hit to the economy, sort of like a V- or U-shaped trend that will rebound back more quickly. If we only suffer a short period of havoc, it can help the commercial real estate industry fend off more vacancies over time.

Additionally, owners in the multifamily housing market of the commercial industry can rest more assured. According to data on commercial real estate trends from the last two recessions, multifamily properties proved to be more reliable during tough times compared to industrial and office commercial properties. Data from the last two recessions collected by CBRE shows the multifamily housing market having the shortest negative growth period and the fastest growth past the prior peak. The CBRE research brief includes helpful charts and more information about the commercial real estate trends during those times.

Looking For Guidance When Your Financial Future is Undetermined?

The Katalyst Team is always on top of the latest commercial real estate trends and is willing to share advice with our clients. If you’re wondering what outcome to expect for the commercial real estate market in Des Moines and beyond, contact our team to talk to data and research professionals today.

Leave a Reply

You must be logged in to post a comment.