Many things about 2020 were unprecedented and shrouded in uncertainty, and the commercial real estate market was no exception. Throughout the year, there have been concerns from both renters and property owners as we all navigated this unpredictable territory.

As we look forward to the coming year and the predictions for the multifamily industry in 2021, we’ll first reflect on the trends we saw each quarter in our 2020 commercial market review for Des Moines.

2020 Commercial Market Review: Quarter 1

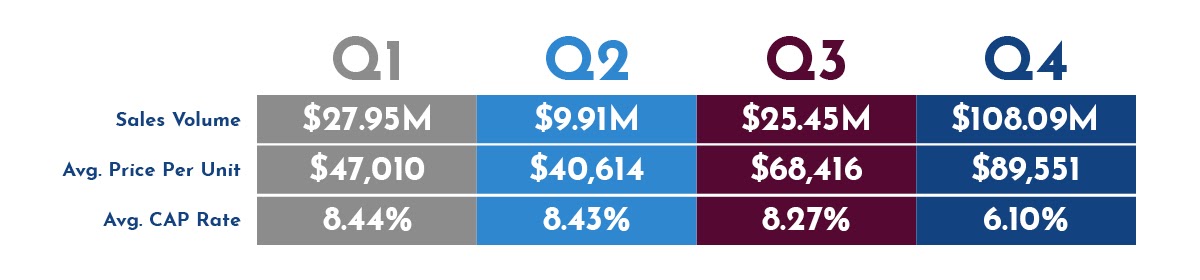

Central Iowa’s multifamily industry in 2019 ended on a high note, and that momentum carried over into the first months of 2020. The year started off looking very promising for Des Moines commercial real estate trends, with a Q1 sales volume more than twice the volume we saw in Q1 2019.

However, in the early months of 2020, a recession began. Iowa’s economy was already beginning to trend down during Q1, due to factors unrelated to the COVID-19 health crisis. But COVID-19 made things worse and triggered what most economists refer to as a “Black Swan” event. A Black Swan event is an unpredictable event that can suddenly change the direction of a market. A similar market event occurred after the events of 9/11.

In Q1, property owners started paying close attention to occupancy rates and lease-renewal rates to see how this economic uncertainty would impact renting behaviors. The outlook for Q2 was bleak, but we hoped for some clarity on the future market performance.

2020 Commercial Market Review: Quarter 2

As we moved into Q2, pandemic precautions persisted and things continued to be in a state of uncertainty. Initially, no one expected COVID-19 precautions and shutdowns to last all through the second quarter, and the uncertainty led to a stall in the market.

Sales volume fell to under $10 million — 45% of last year’s Q2 performance. But the market wasn’t completely shut down. Price per unit and CAP rate for Q2 multifamily transactions remained fairly consistent.

Although there were still a lot of unknowns in Q2, it was clear the economy was in a recession — maybe even a depression. COVID-19 has caused one of the biggest market disruptions in history. Iowa’s economy fared well in Q2 compared to surrounding states, mostly due to lower COVID case numbers and fewer COVID-related deaths.

The multifamily sector was also faring well compared to other commercial real estate markets. According to Katalyst Team surveys, 90% of Central Iowa multifamily tenants were able to pay the majority of their lease payments in April & May. The stock market began to rebound in Q2, surging 38% from its fall in March. Many property owners took advantage of refinancing options, and the Federal Reserve announced plans to keep rates low through the end of 2021.

2020 Commercial Market Review: Quarter 3

As we continued to learn more about the coronavirus and adjusted to life in a pandemic, confidence in the market rose during Q3. Sales volume almost matched Q1, and although the average commercial real estate deal in central Iowa was smaller, the local market began to bounce back.

In Q3, we started to see a K-shaped recovery from the economic recession that began due to the pandemic. A K-shaped economic recovery occurs when certain industries recover sooner than others. This makes sense, as local, national and global health precautions and restrictions remained in place.

Q3 also saw a 2.6% jump in homeownership, which amounts to thousands of renters lost in the commercial real estate market. This exodus from the rental market is most likely to affect the Class A multifamily sector — people who are choosing to rent versus renting by necessity. Property owners are watching for higher vacancy rates in Class A luxury apartments.

2020 Commercial Market Review: Quarter 4

In spite of a tumultuous year, the Des Moines commercial real estate market ended 2020 with one of the largest sales volumes on record: $108.09 million. This activity equates to what central Iowa would normally see in one full year! While most transactions were smaller, like the ones we saw in Q3, most of this success can be attributed to a record-breaking sale of a 509-unit spread sold for $55.67 million at a 5.15% CAP rate.

The Iowa economy continues to remain resilient during the pandemic, with positive leading indicators of growth for the state in 2021. Additionally, Iowa’s 3.3% unemployment rate is better than the national average of 6.7%, which means tenants are more likely to be employed and able to pay their rent.

In Q4, we saw residential building permits slow. While this is normal for winter months, it could mean we’ll continue to see a supply shortage in homes for sale and for rent. Watch for occupancy rates going into the spring to get a pulse of the market.

Keep Track of the Des Moines Multifamily Industry in 2021

At the Katalyst Team, we keep our finger on the pulse of local rental markets. If you’re a current or aspiring property owner, follow our updates on the multifamily industry in 2021. Reach out to our team if you have any questions about the current market or future outlook, and browse our property listings if you’re looking to explore new investment opportunities.

Leave a Reply

You must be logged in to post a comment.