The economy was shaken by the global pandemic and many people have had to adjust their professional lives drastically. Entire industries were affected and many are still experiencing the impacts of the recession brought on by COVID-19.

While some things are starting to look up, we expect a number of the negative effects to be long-lasting. The experts at Katalyst are sharing insights on how the pandemic has and continues to impact the economy, and what commercial real estate will look like post-pandemic.

Different Types of Recessions

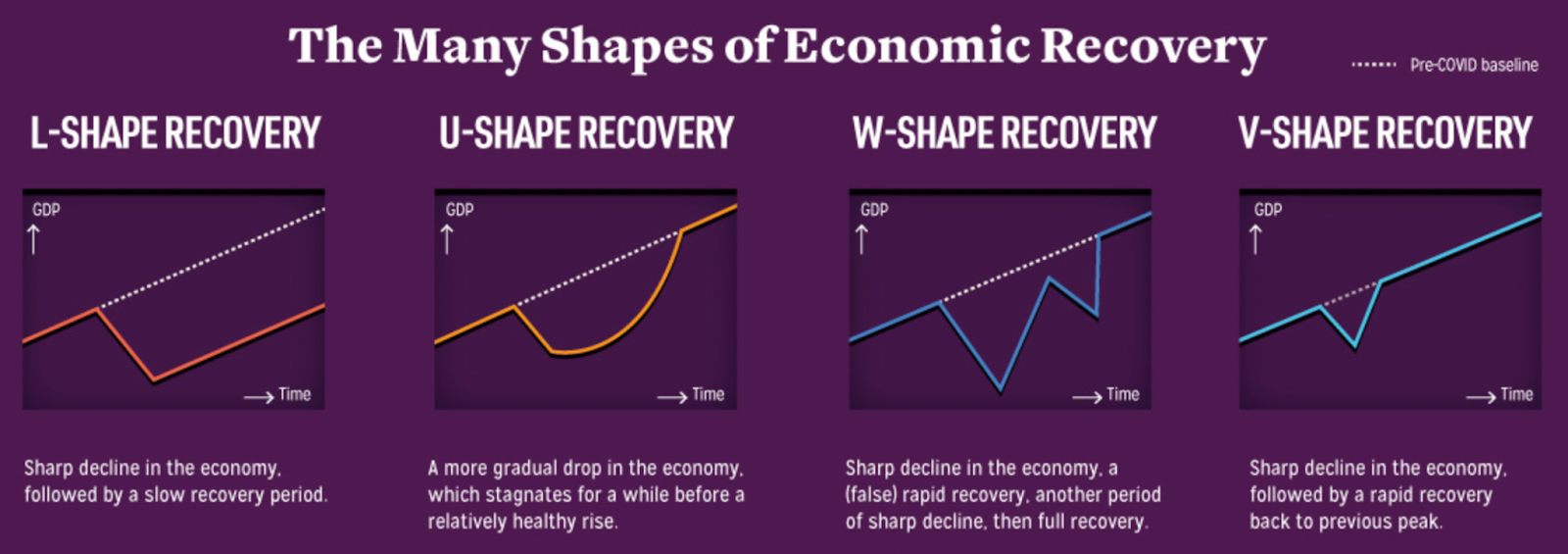

There are different types of recessions and recoveries, all of which are commonly represented by a letter that represents what the economic situation looks like when plotted on a graph. Economists and business decision makers can use these letters to better understand the economic state throughout the recession and to predict what the financial future will look like. The primary types of recessions are:

- V-Shape – A V-shaped recession is the optimal recovery an economy can experience from a recession. This shape shows that the economy recovered quickly and to the state in which it was before the recession.

- U-Shape – A U-shaped recession shows analysts that while the economy did have a sharp decline and eventually rose back to its pre-recession state, the trough is undefined. There was a period of stagnation before the economy began to recover.

- W-Shape – A W-shaped recession, also referred to as a double-dip recession, represents the economy dropping twice. Initially, it starts out as a V-shaped recession, But, after showing false signs of recovery, the economy drops again before fully recovering to its pre-recession state.

- L-Shape – L-Shaped recessions portray a steep economic decline that is not followed by a quick recovery. Instead, the economy experiences persistent unemployment and static economic growth.

Photo credit: visualcapitalist.com

What is a K-shape recession?

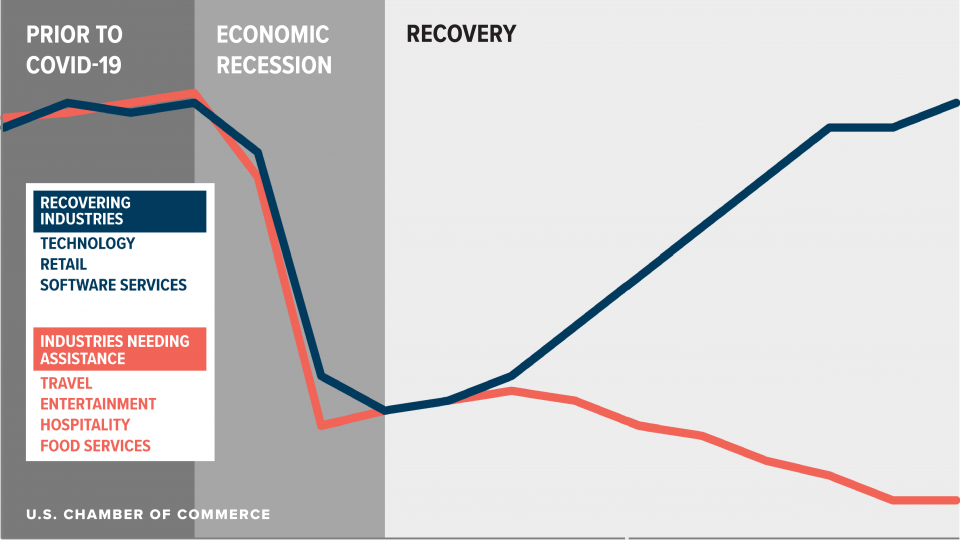

Typically, the people of a nation will experience economic changes as a whole, meaning the economic state would be represented by only one line if plotted on a graph. The K shape however, is rare and relatively new to analysts. A K-shaped recession is caused when one area of the economy prospers and another area suffers.

Photo credit: uschamber.com

When our economy was faced with the impact of COVID-19, some industries thrived while others were halted. Industries like hospitality, food, and travel that rely heavily on foot traffic and face-to-face interactions were tremendously and negatively affected. In many cases, rules and regulations put in place to keep people safe from the virus caused businesses in these industries to close. On the other hand, technology, online retail, and similar industries saw great success as more and more people relied on these industries to purchase goods, services and more. When this type of recovery occurs and is then plotted on a graph, one line is used to represent the portion of the economy which thrived, and a second line is used to represent industries that were halted.

The Commercial Real Estate Industry Post-Pandemic

Throughout 2020 and into 2021, there has been a lot of economic uncertainty. One of the biggest questions for business and property owners was: how will the global pandemic impact the commercial real estate market?

- Single Family Rentals Outperforming Multifamily: Financial issues faced by families and businesses during the pandemic caused home foreclosures. This could lead those who used to own a home to start renting instead.

- Higher Rent Demand = Higher Prices: People delaying homeownership and the homeowners who faced home foreclosures are causing increased demand for rental properties. Property owners may recognize this surplus and raise rates accordingly.

- Stability Depends on Class: Class A apartments have been more stable in rent collection during the pandemic since they are typically rented by individuals with a relatively high income or job security. However, Class C apartment owners have likely found it harder to collect rent payments. Because tenants of Class C apartments are usually people with service industry jobs or jobs that require in-person contact, COVID-19 rules and restrictions may have prevented them from working and making the money needed to pay rent.

- Property Owners Need to Stay Alert: Property owners with multifamily investments need to regularly review their business strategies throughout the recovery period of COVID-19 and beyond. Doing so will allow them to keep up with trends and make the most of their investment.

Keep Up With Commercial Real Estate Trends Post-Pandemic

The Katalyst Team has years of experience in commercial real estate and can help you better understand the recession’s impact on the commercial real estate industry. We encourage you to contact our team of licensed real estate agents in Des Moines with any questions about commercial real estate, current listing, localized investments in Iowa, and more. Reach out today.

Leave a Reply

You must be logged in to post a comment.