Which is More Important: Return on Investment or Return on Equity?

There are many ways to calculate the value of a real estate investment: return on investment, cash-on-cash, internal rate of return and more. Individuals should study a variety of different financial ratios before investing in rental property.

One calculation, return on equity (ROE), provides important insights about the impact of changes in the market and shifts in commercial real estate trends. Savvy property investors need to continually evaluate how these outside factors could affect the value of their property. Read on to learn more on how to calculate return on equity and use ROE data to make key investment decisions.

What’s the Difference Between Return on Investment & Return on Equity?

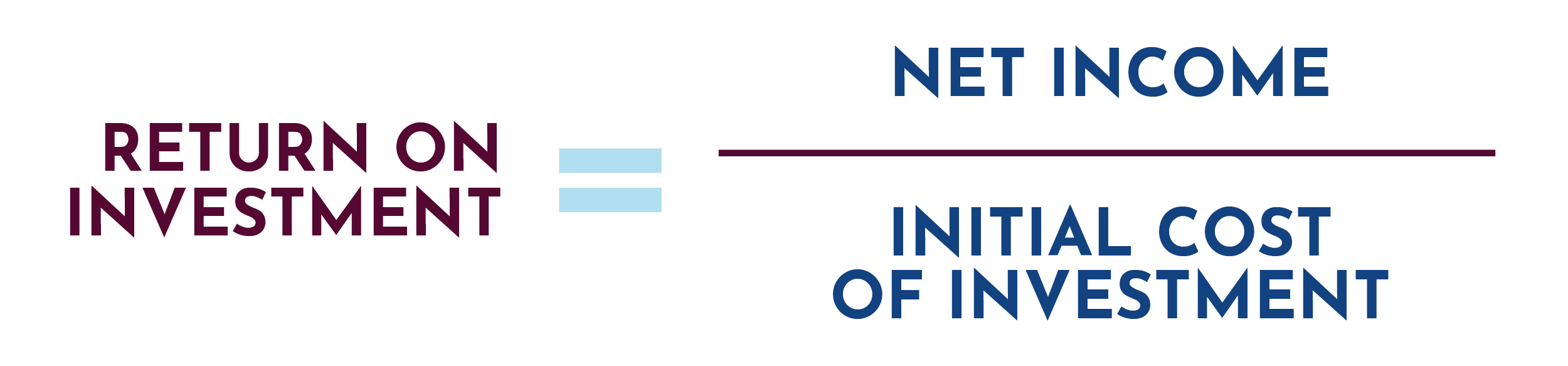

Return on investment is a financial ratio between net profit and cost of investment. Return on equity is another measure of financial performance used to help investors understand the value of an investment. Unlike ROI, ROE takes into account value appreciation and additional factors.

How to Calculate Return on Equity for Commercial Real Estate

Return on equity is calculated using a formula of net income divided by shareholder’s equity. In real estate, the formula is better described as cash flow after taxes divided by the sum total of initial cash investment plus any additional equity that has built up as you’ve made mortgage payments. If your property value has increased, this should also be considered when you summarize your total equity and perform your ROE calculations.

How to Calculate Return on Investment for Rental Properties

Return on investment calculations are a ratio of net profit divided by the original cost of the investment. Finding your net profit will require more calculations, as you’ll need to consider maintenance expenses, utility costs, taxes and other costs incurred during remodeling and other projects. Learn more with our guide to calculating ROI on property investments.

ROI may be a simpler and more straightforward formula, but ROE can offer additional insights about property value appreciation.

Why Buyers Should Pay Attention to ROE When Investing in Rental Property

A property’s return on equity is a more fluid figure when compared to ROI, but it’s important to continually track ROE in addition to ROI. If you’re investing in rental property, keeping an eye on your ROE helps you understand the true value of your property.

Using ROE to Earn More on Your Investments

ROE and value analysis is extremely useful for helping property investors decide when it may be time to sell an asset and reinvest their capital in a more profitable property.

For example, imagine investing $1,000,000 in a property that provides $100,000 annual net income. One year after purchasing this property, your return on equity is approximately 10%. After a few years, surrounding development and building improvements double your property value. This $2,000,000 property is still bringing in $100,000 annual net income, and your ROE has dropped to 5%.

If you were to sell this property for $2,000,000 and reinvest that $2,000,000 in a property with a 10% annual return on investment, your annual cash flow would double. You’d now be earning $200,000 annually — all because you tapped into your equity and used it more efficiently.

Investing in your rental property with remodeling and other updates will increase the property value, but it’s often difficult to increase cash flow without astronomical, unrealistic increases in rent. Increase cash flow by selling your property and reinvesting in an asset that brings in more money annually. As your new property’s equity grows, continue periodically evaluating your new ROE.

Learn How to Calculate Return on Equity and Keep Up With Commercial Real Estate Trends

The Katalyst Team has years of experience in commercial real estate. If you’re investing in rental property, our experts can help you calculate how to get the best return from your property investment. Reach out today for a professional real estate value analysis or more tips for optimizing your commercial investments.

Leave a Reply

You must be logged in to post a comment.