Although investing in multifamily properties can be expensive when compared to purchasing a single-family rental property or home, many investors are finding success with multifamily rentals. This article is for anyone who has ever wondered, “Are rental properties a good investment?” Read on to explore three reasons savvy real estate property owners choose to purchase commercial real estate and agree multifamily rental properties are a good investment.

Reason #1: Rising Construction Costs Make Purchasing Commercial Real Estate More Profitable Than Single-Family Properties

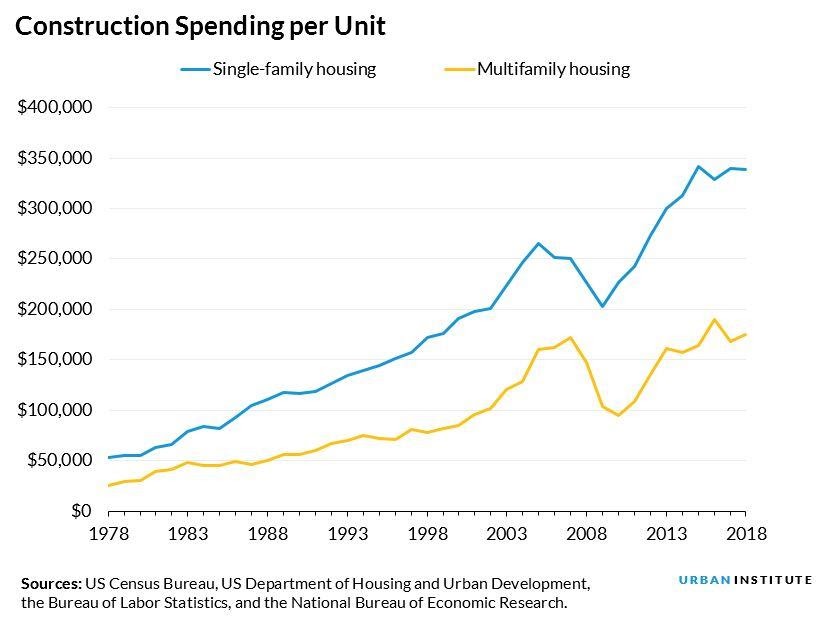

In the past few years, the costs associated with new construction have increased across single-family and multifamily markets. Industry-wide construction cost increases are often due to a number of different factors, including normal inflation and international trade considerations like high tariffs.

A 2018 article published by the Associated General Contractors of America reported rising costs of materials such as fuel, iron, steel, softwood lumber and asphalt. The average cost increase for construction materials was estimated to be 7.4% compared to 2017. Despite relatively stable costs in 2019, some industry experts estimate more cost increases in 2020.

Rising land costs are another factor making it more expensive to build single-family homes. Lot prices typically increase along with a typical rate of inflation, but the past years have seen more rapid lot price increases.

A final issue contributing to rising construction costs is a labor shortage in the construction industry. This shortage is likely due to a combination of factors such as historically low unemployment rates and a large segment of the workforce reaching retirement age.

Mitigating Rising Costs With Multifamily Housing

The rising costs impact all facets of the housing industry. Investing in multifamily properties will not completely prevent investors from being exposed to these rising costs. However, purchasing commercial real estate with multiple units often leads to greater ROI overall and increased monthly cash flow. As a multifamily property owner you’ll be, in a sense, getting more “bang for your buck.”

Photo credit: Urban Institute

The upfront expense of a multifamily property may seem intimidating, but the overall value and earning potential makes it a lucrative real estate investment option.

Reason #2: The Housing Supply Crisis Makes Rental Properties a Good Investment

Due to rising construction costs, fewer houses are being built. With overall low supply, demand is driving up prices and houses are selling quickly once they’re listed for sale. The low housing supply and competitive market cause potential buyers to spend more time renting because they simply can’t find the right house or they can’t afford inflated housing prices.

Although housing supply is currently low, demand is very high. The two largest generation groups, baby boomers and millennials, are both in the market. In some cases, these two groups may even be competing with one another for similar houses because millennials are looking for smaller, more affordable starter homes, and baby boomers are looking to downsize.

High demand and low supply in the housing market is ideal for property owners with multifamily rental properties. As potential homebuyers are forced to wait longer and pay more for the perfect house, they’ll spend more time renting. As a result, the demand for apartments, townhomes, condos and other multifamily buildings will rise.

Reason #3: Lifestyle Changes Among Younger Generations Encourages Individuals to Rent Longer

In addition to the competitive housing market forcing people to forgo home buying in favor of renting, there is a growing population of people who simply prefer renting. Millennials, especially, prefer renting an apartment or townhome instead of owning a house.

Purchasing commercial real estate now while Millennial and Gen Z buyers are still on the rise makes rental properties good investments that will quickly pay off. Many sources speculate about the reasons millennials prefer renting:

- They don’t want to deal with the responsibility and hidden costs of homeownership.

- They have more student loan debt and struggle to save for a down payment.

- They marry and start their families later than previous generations.

- They value mobility and travel and don’t want to be tied down to one location.

- They want to live in popular urban areas without the high cost and risk of investing in real estate.

There are many more reasons for people of all ages to stick to renting over diving into homeownership. As renting continues to be popular among younger generations, multifamily property owners can benefit from the higher demand for rental properties.

Are Rental Properties a Good Investment For You?

No matter your goals or life stage, purchasing multifamily property to rent out can be one of the best investment decisions you ever make. If you want to learn more about investing in multifamily properties, reach out to our team. We are happy to answer any questions you have about the multifamily real estate industry.

Take a look at our current listings to find potential properties for your next investment! Whether it’s your first investment or your 50th, we’ll be right by your side when you make the decision to purchase commercial real estate.

Leave a Reply

You must be logged in to post a comment.