Thoughts From Jared

I just returned from Argentina and climbing the TALLEST mountain outside of the Himalayan mountain range: Mt. Aconcagua. Standing at 22,837 ft above sea level it is known as the “Stone Sentential” as it’s full of rocks, gravel, dust, and snow. Additionally, located near the Pacific ocean it is known to be windy as the oceanic winds hit with wind speeds upwards of 70 mph some days and temperatures at summit of -40 degrees sometimes. While on this trip I had the distinct experience of reflecting on how many lessons apply to life and business such as: having the right guide, having the right team, being properly prepared physically and mentally, and being properly equipped with gear; to name but a few of the lessons.

When we go through life and business how important is it for us to have mentors and leaders? AKA: Guides? These can be parents, mentors, coaches, etc. These are people who have been where we want to go and we rely upon them to help us reach a NEW area in our life or business!

Having a great team of positive people around you who each bring their own skillset and experience to your life or business almost explains itself; whether it’s a spouse or family member who’s your cheerleader, business partner, or something different to actual members of our team who help us with our blind spots like paperwork, marketing, IT, etc. Having the right team around all of us MATTERS!

Physically and mentally being prepared for life and business also, almost speaks for itself. As Rocky Balboa said, “No one is going to hit as hard as life.” we have to keep our bodies and our mental state in a constant state of growth and expansion as well as positivity in order to deal with the life challenges that life and business will throw at us on a daily basis sometimes!

Proper equipment speak to the tools we use to make our life and business easier, from software to computers to the internet we are constantly utilizing tools and equipment to make our life easier. In fact, this Quarter Report is an example of a tool that we at The KataLYST Team put out for all of YOU! It’s a tool to track the market and see where things are and hopefully, where they are going through reports, webinars, emails, phone calls, texts, etc. our goal is to help you provide the tools to thrive in your real estate investing career and business WHICH ultimately helps you thrive further in life! This is our goal and mission at The KataLYST; Team to help people thrive…

And we do this through providing tools for knowledge and education, positive outlooks, being a team member in your real estate needs, and hopefully being chosen as “guides” in your buying and selling process when that time comes…

Our goal, is YOUR ultimate summit (and vision) of your life through this thing we take part in called real estate…

With that all said, let’s pack our bags, lace our boots, and gear up for what this Quarter provided for multifamily real estate sales within Iowa; THE SUMMIT BECKONS!

Executive Summary

What Does this Report Say in Less than 3-Minutes?

Central Iowa Apartment Market Q2 2024 Performance

- Sales Volume: $52.2 Million Sales Volume

- Price Per Unit: $75,420

- Price Per Square Foot: $89.08

- Cap Rate: 5.44%

Eastern Iowa Apartment Market Q2 2024 Performance

- Sales Volume: $19.0 Million Sales Volume

- Price Per Unit: $87,139

- Price Per Square Foot: $101.59

- Cap Rate: 6.77%

National Multifamily Market Insights

- Occupancy Rate: 94.7% (steady year-over-year)

- Rent Growth: Flat nationally, but the Midwest and Northeast continue to outperform other regions.

- Development: A large pipeline of new high-end developments is affecting pricing nationally, but Iowa’s focus on affordable housing continues to perform well.

Three Things to ALWAYS Consider…

- Buying Opportunities

- Central Iowa’s TRUE Cap Rate is VERY Low at 5.44%!

- Eastern Iowa, with lover per-unit costs, presents opportunities for smaller investors or those looking for value and cashflow in a less competitive market.

- Holding & Refinancing

- With REAL borrowing costs remaining high, now is NOT the time to refinance.

- Selling or Disposing

- The Iowa Market continues to gain interest from investors and NOW may be a good time to consider a sale!

What Does This Mean for Investors?

- Buyers: Most of the best opportunities right now with higher cap rates are coming from “off-market” deals.

- Sellers: Iowa continues to be popular for investors, selling NOW can be quite profitable!

The Iowa Market Summarized in Two Sentences…

Iowa’s multifamily market offers great buying opportunities in both Central and Eastern Iowa, with a focus on affordability and stable returns. As national markets face challenges, Iowa continues to shine, making it an excellent time for investors to explore local opportunities…

Central Iowa Multifamily

How Did Central Iowa’s Apartment Market Perform Last Quarter?

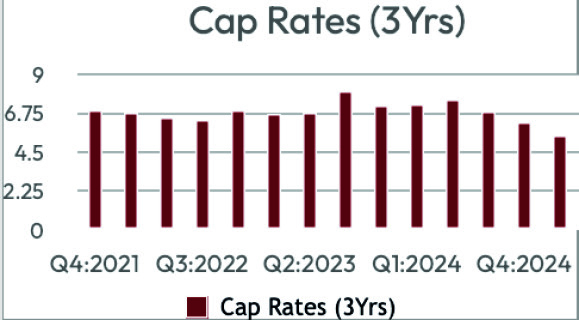

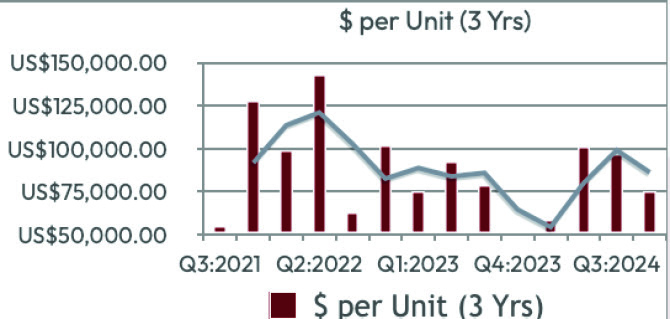

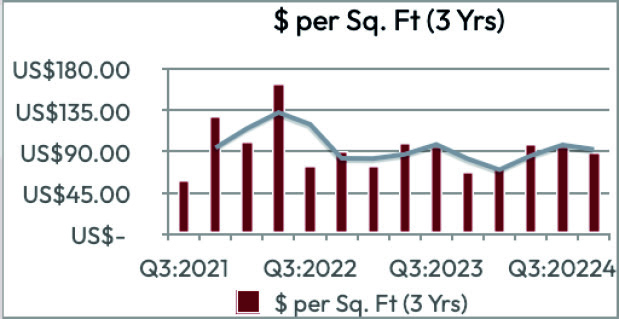

For the 4th quarter of 2024 and close of the year we saw 9 sales occur with the average property being of 1962 vintage and consisting of 77 apartment units resulting in $52.19 million of sales volume, an average price per unit of $75,420, an average price per square foot of $89.08, and average cap rate of 5.44% (actual).

What trends did WE identify in the Statistics?

- Cap Rates were SIGNIFICANTLY lower in the 4th quarter compared to previous point in the year.

- Consistent with past quarters, 66% of all buyers were considered “out-of-state.”

- While Cap rates were VERY low; the price per unit, square foot, and sales volume were all within reasonable expectations compared to past quarters – this is perhaps because this quarter is reflective of TRUE cap rates rather than “Pro-Forma’s.”

How will these trends affect?

- Buying or Acquiring?

- Competition with “Out-of-Market” ownership groups remain strong which continues to bolster the Central Iowa Market place and make it difficult for local ownership groups to compete.

- Of the deal completed by local investors, 75% of them were less than 12-unit purchases.

- How to win deals? 44.4% of all deals completed this past quarter were “off-market” transactions which means having strong relationships with brokers and owners is creating the BEST buying opportunities.

- Holding or Refinancing?

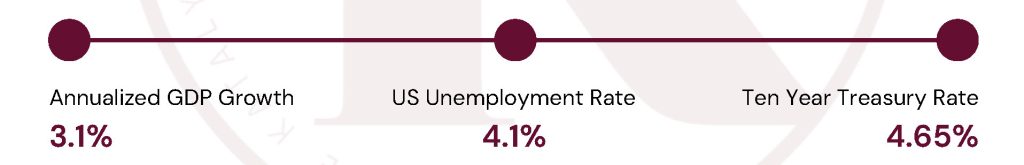

- The 10-year treasury is hitting a 1-year high DESPITE the Federal Reserve dropping interest rates with no-sight of further reductions coming; refinancing does not appear to be a good prospect for the next 3-6 months.

- Insurance premiums, especially deductibles and “wind-and-hail” exclusions continue to frustrate ownership groups; to know WHO is still insuring please reach out to us at The KataLYST Team!

- Selling of Disposing?

- With a new congress in Washington D.C., new policies, and remaining interest in the Central Iowa marketplace; selling continues to be a great option for ownership groups!

- To find the best ways to MAXIMIZE your value and showcase your property for sale in the Spring give us a call to discuss your best options!

Eastern Iowa Multifamily

How Did Eastern Iowa’s Apartment Market Perform Last Quarter?

For the 4th quarter of 2024 we saw 6 sales in Eastern Iowa for a total of $19.03 million of sales volume, $87,139 average price per unit, $101.59 average price per sq. ft, and a 6.77% average Cap rate.

What trends did WE identify in the Statistics?

- It appears that Easter Iowa is attracting strong capital and prices in the search for yield with prices stronger last quarter than even Central Iowa.

- The average sale in Easter Iowa consisted of 50 unites with a vintage of 1984; this newer asset helps explain the stronger prices per square foot and prices per unit prices seen than previous quarters.

How will these trends effect:

- Buying or Acquiring?

- Cap rates appear to be trending lower while prices are remaining stable or rising; now is a good time to purchase and ride the market higher in Eastern Iowa.

- To hear about upcoming listings or deal flow contact our team!

- Holding or Refinancing?

- With refinancing rates remaining high, now is NOT the time to consider a refinance until the market stabilizes coming into 2025.

- If you are considering holding, prices should continue to rise in the foreseeable future in Eastern Iowa; however, be cautious of higher expenses and inflation reducing your net-profitability.

- Selling or Disposing?

- Prices are continuing to grow in Eastern Iowa as investors search for yield, buying or holding is presumably a better option for the next 2-3 months.

- If you are looking to sell in the Spring, NOW is the time to begin preparing your property for sale; contact our team to see how you can position your property for the MOST profit!

Iowa Economy

How do we track the Iowa Economy?

As begin 2025 and looking at the Iowa economy, it appear that over the past 6-months the economy has begun to bounce back with 5 of the 8 Leading Indicators appearing positive. Of the 8-indicators only Diesel Fuel, Unemployment, and Agricultural Futures were declining while the remaining 5-factors (Yield Spread, Stock Market, Building Permits, Manufacturing Hours, and New Orders) all positively affected the indicators.

Also, worth noting, was the election results from Iowa which left the Republican part in super-majority across both the Senate and House as well as the Gubernatorial. Thus far, Republicans have already addressed that in the 2025 legislature and session they want to look at property taxes and state income taxes as a way to make Iowa more competitive in the business landscape.

What does all this mean?

- The Iowa Leading Indicators has been increasing over the last 6-months which showcases that the Iowa economy (along with the nation perhaps) continues to remain resilient and push ahead with growth.

Which are the most important for real estate?

- The yield on interest rates may have come down on a Federal level; however, the REAL borrowing rates continue to remain high in the 7%’s making new projects challenging to hit profitability with continual higher prices asked by sellers AND higher expenses through insurance premiums and inflation.

What Do I See in These Statistics?

- While owners continue to battle inflation and higher expenses, the average person is feeling it more harshly and our economy continues it’s K-shaped growth (for more information on a K-shaped economy give us a call); this is squeezing consumers paychecks and making it harder for the average resident to pay rent, afford childcare, etc.

- I predict that vacancy rates as well as delinquency rates to remain higher for most ownership groups throughout Iowa.

National Economy

Economy Data

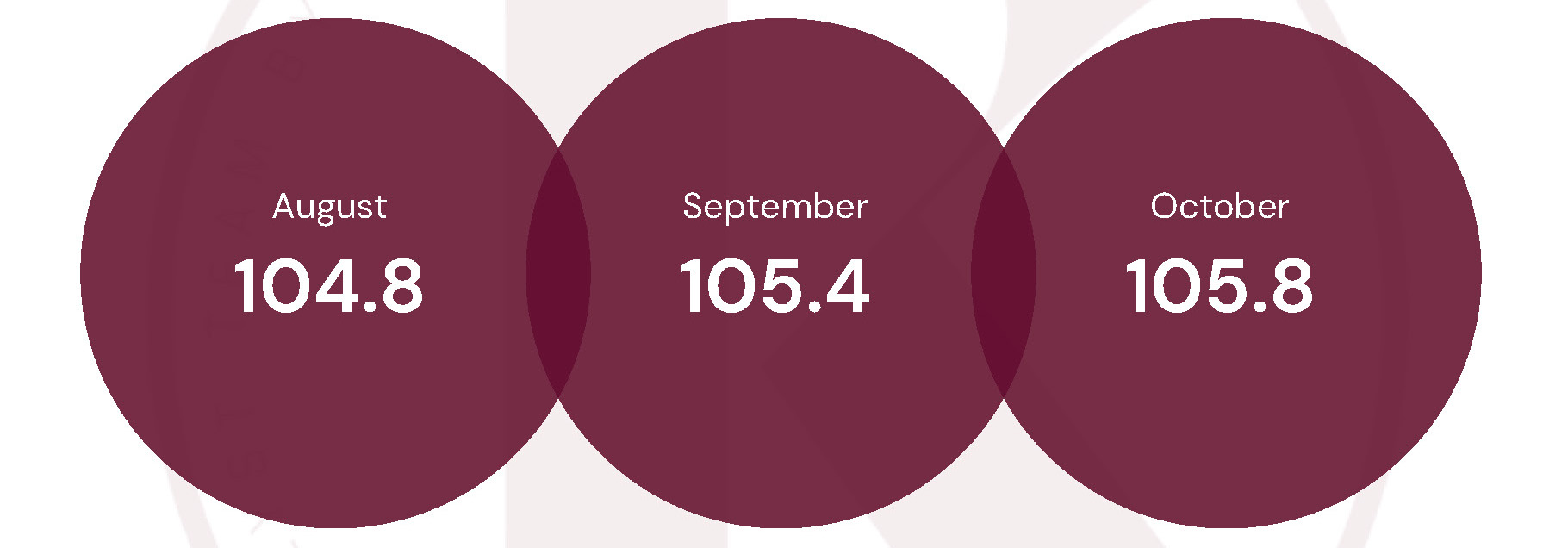

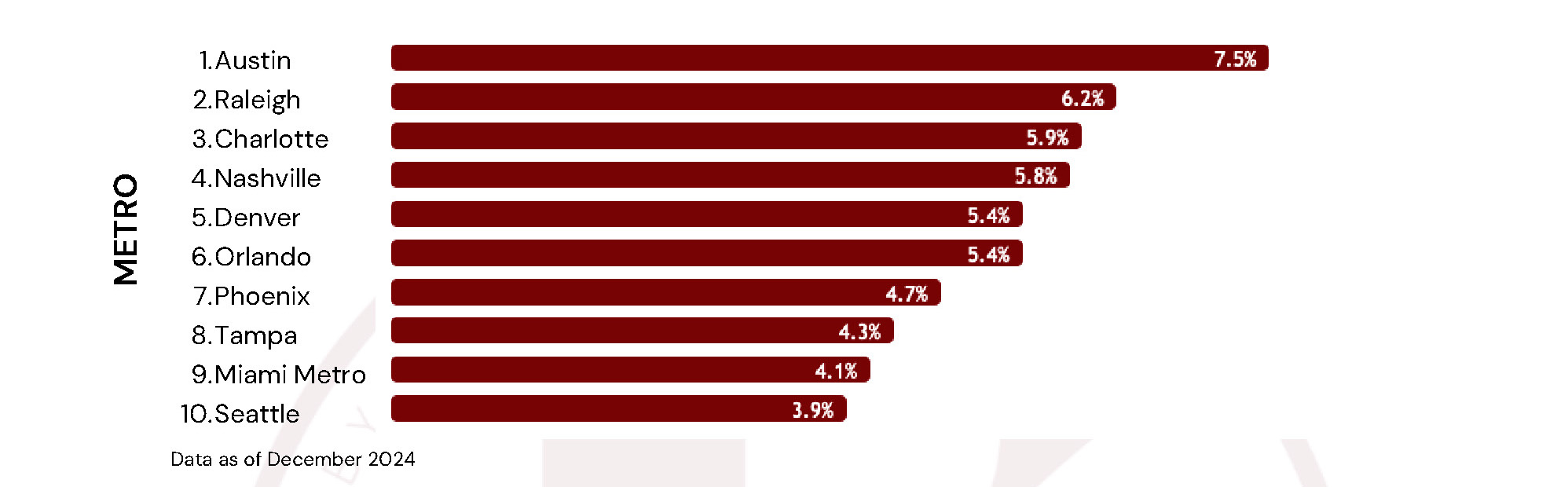

Nationally the multifamily sector is seeing slight declines in rental growth in the face of new-supply coming on the market as well as seasonality; furthermore, occupancy rates also remain lower in the face of the new-supply being developed and delivered. Despite these elevated levels, certain regions continue to thrive such as the Midwest and Northeast which have not seen the construction boom seen in the South and Southeast.

What to Watch

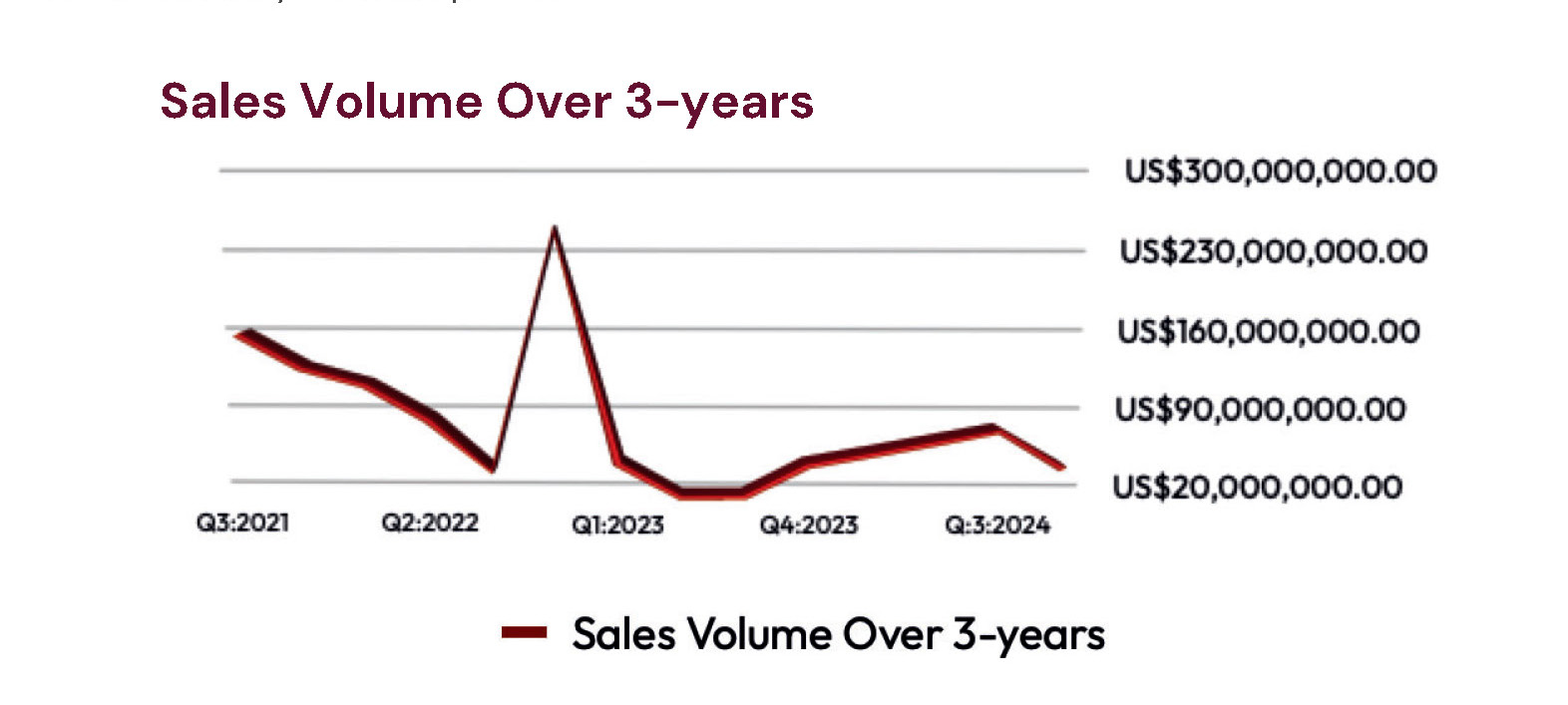

- Areas across the country are being affected very differently from the new-supply of Multifamily that is being developed as seen by the graph above; the Northeast and Midwest continue to remain strong due to lack of new development.

- Many of the rent decline and concessions appear to be happening in the A+ and highly amenitized apartments; with a focus on quality and knowing what residents “want” ownership groups are continuing to do well.

- Don’t let national headlines fool you, the REAL interest rates being offered by most lending institutions are still high unless you are able to obtain Freddie Mac or Fannie Mae debt.

How to Profit

- Buying or Acquiring?

- The window for interest rates appears to have “closed” with no sight of continued reductions. If you are looking to buy or acquire “off-market” deals will be the best source of profitability.

- Contact us to learn what we know about at The KataLYST Team!

- Holding or Refinancing?

- Now does NOT appear a good time to refinance; WAIT!

- Insurance continues to frustrate Iowa multifamily ownership; to learn about who is still in the market please contact us here at The KataLYST Team!

- Selling or Disposing?

- It is our belief that values and prices will continue to rise across Iowa over the next 3-5 years HOWEVER, Net-incomes will remain flat, be open to off-market offers, transactions, etc. as a way to capitalize on a strong price and mitigate flat new-incomes.

What have WE been Selling and LYSTing JUST in 2025?

UNDER CONTRACT

2101 University Ave, Des Moines IA

UNDER CONTRACT

Triangle Court, Osage IA

UNDER CONTRACT

420 Water St, Center Point IA

UNDER CONTRACT

60-64 Miller Ave SW, Cedar Rapids IA

For more information on Listed, Sold, or Sale Pending properties please contact me! Thank you.

Disclaimer

Provider is a licensed real estate agent and has the rights to sell real estate in the state of Iowa.

All information was obtained via 3rd parties including but not limited to Yardi Matrix, Iowa-Leading Economic Indicators, CoStar, and more. All effort

was made to ensure the accuracy, timeliness, and completeness of information provided for publication. KW Commercial does not guarantee, warrant,

or represent that all information is accurate or complete and is not liable for any loss, claim, or demand arising from the direct or indirect use or

reliance upon information provided.

Behind the Desk

Jared is a 3rd generation real estate entrepreneur growing up with a grandfather who was a homebuilder and investor; a father who was an electrician, developer, and investor; and a mother who was a residential investor, manager, and bookkeeper. With this extensive knowledge as well as being an owner himself for over 15+ years and involved in over 200+ individual transactions he has extensive experience in; financing, operations, management, development, construction, bookkeeping, brokerage, and entrepreneurial activities.

Having helped clients purchase and sell over $100+ Million of real estate personally as an agent-advisor Jared has helped his average client earn over 26.95% rate of return on their real estate investments.

In his spare time has has many hobbies which include but are not limited to: traveling, mountain climbing, hiking, piano, ballroom dancing, Latin dancing, pilot, Spanish lessons, and is always looking for a new adventure.