Thoughts From Jared

“If you’re going through hell… keep going!”

– Winston Churchill

Winston Churchill’s words feel especially relevant after the past 12-18 months in commercial real estate. As interest rates doubled overnight and inflation soared, both development and investment sales slowed. With the Federal Reserve’s recent half-point rate cut and another expected soon, we may be finally emerging from this “hell.”

In spite of this, we’re not out of the woods just yet, the upcoming election will shape the next few years of both the economy and the political climate and as we brace for what’s ahead, the saying “Survive ’til ’25” may prove accurate, with things gradually returning to a “new normal.”

Despite these nationwide challenges, Iowa’s commercial real estate market has remained remarkably steady. While sales volumes dropped sharply in 2023, 2024 looks poised for a solid performance; pricing has held strong, dipping only about 10% in the first quarter, reflecting Iowa’s history of weathering market cycles better than most!

As the ship begins to steady—with interest rates leveling and inflation cooling—it seems we’ve made it through “hell.” But only time will tell!

Regardless of what the market or election brings, there are always opportunities. Our job is to find them and make the best decisions for our customers, investors, and partners.

With that in mind, let’s dive into what the last quarter has held for us here in Iowa…

Executive Summary

What Does this Report Say in Less than 3-Minutes?

Central Iowa Apartment Market Q2 2024 Performance

- Sales Volume: $83.4 Million Sales Volume

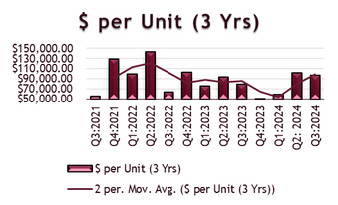

- Price Per Unit: $96,834

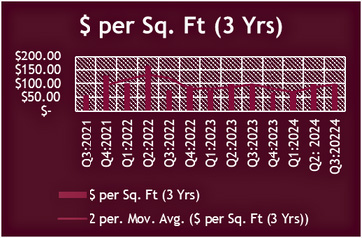

- Price Per Square Foot: $95.43

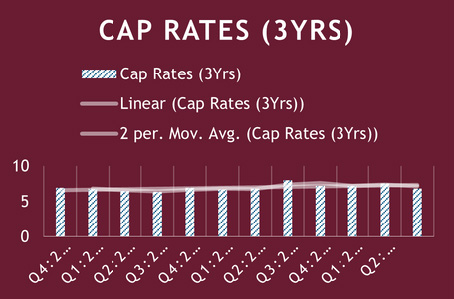

- Cap Rate: 6.25%

Eastern Iowa Apartment Market Q2 2024 Performance

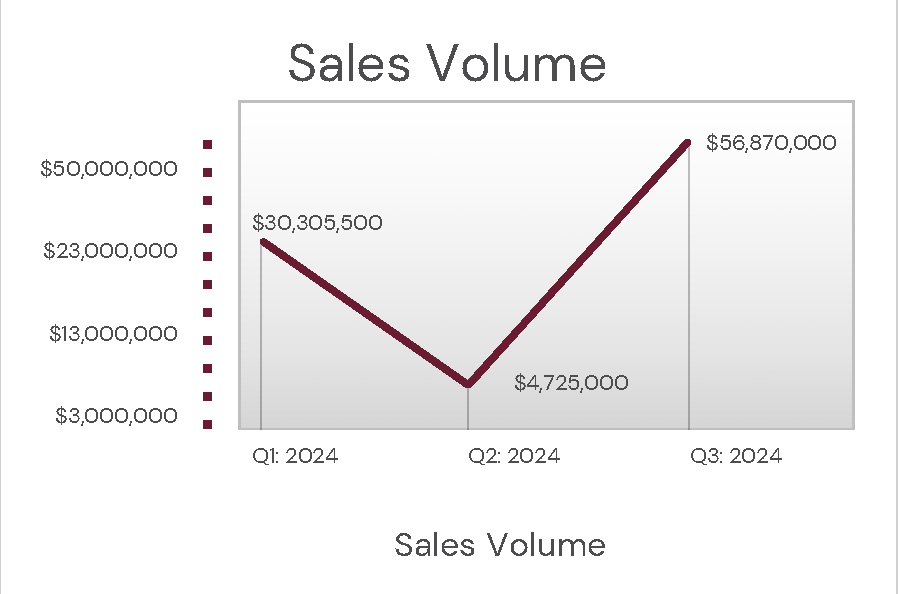

- Sales Volume: $56.8 Million Sales Volume

- Price Per Unit: $80,904

- Price Per Square Foot: $88.57

- Cap Rate: 7.70%

National Multifamily Market Insights

- Occupancy Rate: 94.7% (steady year-over-year)

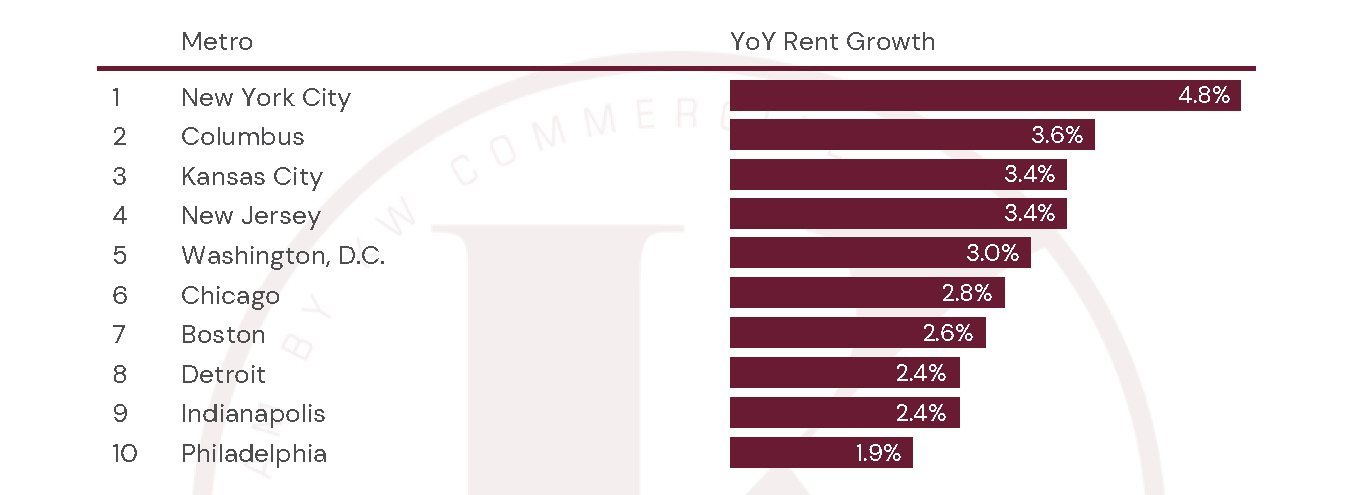

- Rent Growth: Flat nationally, but the Midwest and Northeast continue to outperform other regions.

- Development: A large pipeline of new high-end developments is affecting pricing nationally, but Iowa’s focus on affordable housing continues to perform well.

Three Things to ALWAYS Consider…

- Buying Opportunities

- Central Iowa offers a more stable market with higher price points but consistent cap rates just above 7%.

- Easter Iowa, with lower per-unit costs, presents opportunities for smaller investors or those looking for value in a less competitive market.

- Holding & Refinancing

- With cap rates stabilizing around 7%, holding assets for longer may prove profitable as interest rates remain elevated. Consider whether it’s worth refinancing now or waiting for better market conditions.

- Selling or Disposing

- Current cap rates suggest a balanced market, where it might be a good time to exit if your assets are underperforming or if you’re holding onto older properties with lower returns.

What Does This Mean for Investors?

- Buyers: Look for opportunities in the Midwest, where lower development levels have kept markets steady.

- Sellers: National trends suggest slowing growth in some regions, so Iowa’s relative stability may attract out-of-state investors. Consider selling while demand remains consistent.

The Iowa Market Summarized in Two Sentences…

Iowa’s multifamily market offers great buying opportunities in both Central and Eastern Iowa, with a focus on affordability and stable returns. As national markets face challenges, Iowa continues to shine, making it an excellent time for investors to explore local opportunities.

Central Iowa Market

How Did Central Iowa’s Apartment Market Perform Last Quarter?

For the 3rd quarter of 2024 we saw 14 sales take place which has resulted in our local apartment market remaining resilient and strong in the face or a weakening economy and higher interest rates. Overall, the 3rd quarter came in at $83.47 million of sales volume, 6.25% “true” cap rate, $96,834 average price per unit, and $95.43 average price per unit.

What trends did I identify in the Statistics?

- While “Cap” Rates appear to be lower indicating higher prices, the sales volume, price per unit, and price per square foot are in-line with the 2nd quarter where Cap Rates were at 7.05%. This indicates to me that “True” Cap rates are hovering between 6.25%-7.05%.

- The “Average” sale that is taking place consists of a 60-unit apartment building build in the 1970’s; many buyers appear to be betting on a strong long to midterm rebound in prices, rents, and multifamily.

- 57% of the sales took place with out-of-state buyers actively purchasing.

How will these trends effect:

- Buying or Acquiring?

- Cap rates continue to remain equal with interest rates which means strong operational experience and maintaining a Strategic Plan on “value-add” operations through increasing income or decreasing expenses is essential.

- To brainstorm “value-add” operations or ideas let our team know and we’ll let you know what we’re seeing around the market being done with success!

- Holding?

- Construction costs remain high and rental rates continue to climb in our market, it appears that pricing continues to remain strong in the face of barriers to competition (new development).

- In the face of inflation we are seeing costs skyrocket (especially in insurance), if you’d like a 2nd opinion or review of your expenses or a referral to a trusted professional contact us!

- Selling of Disposing?

- If you are selling, pricing remains strong, however, it will most likely take longer to see than previous years so expect 6+ months prior to a closing. It is worth noting that this longer time frame can affect: taxes, 1031 exchanges, repositioning, etc.

- To successfully plan a sale with the highest net-dollar amount and shortest time frame, contact us and we can work on a plan that will help you reach your long-term and short-term goals!

Eastern Iowa Market

How Did Eastern Iowa’s Apartment Market Perform Last Quarter?

For the 3rd quarter of 2024 we saw 10 sales in Eastern Iowa for a total of $56.87 million of sales volume, $80,904 average price per unit, $88.57 average price per sq. ft, and a 7.70% average Cap rate.

What trends did I identify in the Statistics?

- With Windsor on the River selling at $34 million, it was one of the largest sales in Eastern Iowa and the Cedar Rapids market which drastically boosted sales volume.

- Half of the buyers came from outside of Iowa which appears that Eastern Iowa is now attracting new money to the market who see value in the growing communities.

- Cedar Rapids and I-380 corridor continue to see a lot of development in the face of new businesses like Google and Amazon coming to the corridor; this will cause new growth in the multifamily space but also increased competition.

Nick Wallraff

I was born and raised in Eastern Iowa, I got hooked on real estate investing in 2015 and have not looked back since. My first investment was a live in flip that I sold tax free after 2 years, I then bought a 3 plex to renovate and house-hack. I formed a partnership and closed on a 30 unit building when I was 26 years old. I started real estate full time as a Realtor/investor in 2020 and in 2023 I joined the Katalyst Team to help multifamily investors grow their portfolio through purchases and sales of investment properties. I have personally been involved in all kinds of investment projects, renovations, developments, etc. so I know what to look for. I employ an open-minded, creative approach to find good deals for investors looking to buy and sell real estate. I am sold on real estate’s potential for turning savings and hard work into additional income at the end of each month, and its capacity to build long term wealth.

How will these trends effect:

- Buying or Acquiring?

- The corridor is now attracting out-of-state money which indicates value in the market; coupled with the new business development it appears that now is a good time to purchase in the market that is going up!

- To hear about upcoming listings or deal flow contact our team!

- Holding or Refinancing?

- New development also means increased competition, be cautious of pushing rental rates too aggressively in the face of new competition.

- With rates coming down to more manageable levels, we are seeing the government and agency debt lenders starting to become aggressive and reasonable; be on the lookout to refinance into “Agency” or government backed-debt to secure non-recourse, interest only, and long-term attractive interest rates.

- Selling or Disposing?

- Out of state investors continue to chase “yield,” with the growth of the metropolitan area it may be a great time to sell as market begins to move in an upward trajection.

Iowa Economy

How do we track the Iowa Economy? It’s Harvest Time!

While we normally focus this section on the Iowa Leading Indicators Index, which we will touch on briefly, our focus for once is shifting to Iowa harvest! Because Iowa is primarily an agricultural state the state of the harvest will naturally drive much of the Iowa economy. Thus far, corn conditions are ranking at 77% good-to-excellent with 61% at maturity which is 5-days behind last year but ahead of the historical averages. Furthermore, soy bean’s were also at 78% conditions of good-to-excellent which is all pointing to a robust harvest for farmer’s across the state. In spite of this, corn prices are down 12.4% year over-year and down 38.3% since 2022 at this same time while soy beans are down 12.9% year-over year and 25.2% since 2022 at this same time.

What does this all mean?

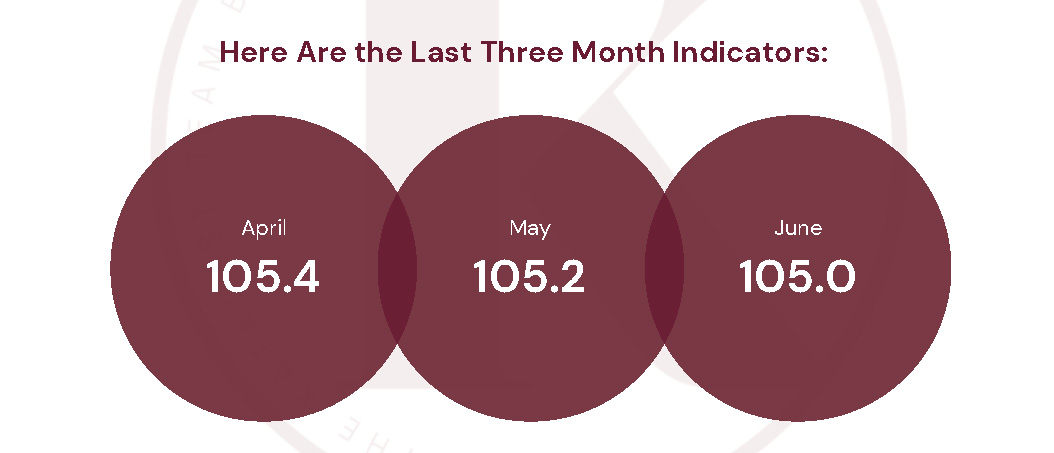

- The Iowa Leading Indicators is down 0.2% which is showing a slight contraction in the Iowa economy.

- With the lower prices of crops like corn and soy-beans it appears that the overall Iowa economy is struggling with only 3 of the 8 “Leading Indicators” showing positive growth.

Which are the most important for real estate?

- The yield curve (interest rates) is starting to improve with the Federal Reserves recent downgrade; however, the value of commercial real estate is still very neutral in relation to the borrowing costs.

- Building permits and unemployment are also showing negative growth and coupled with high credit-card debt, it appears that many consumers are not feeling overly excited about the economy.

What Do I See in These Statistics?

While owners continue to battle inflation and higher expenses, the average person is feeling it more harshly and our economy continues it’s K-shaped growth (for more information on a K-shaped economy give us a call); this is squeezing consumers paychecks and making it harder for the average resident to pay rent, afford childcare, etc.

National Economy

What is Happening Nationally In the Multifamily Market?

Nationally the multifamily sector is going through changes, investment sales activity is at $19.3 billion and down 24% year-over-year and rental growth remains flat at 1.0% year-to-date. High supply levels continue to hinder rent growth, especially in the South and Southeast; while the Northeast and Midwest continue to do well.

What are Some Trends Nationally?

- The reduction of interest rates while applauded, also showcases a weakening economy and higher unemployment rates nationwide.

- Locally we are still experiencing a strong economy with less than 2.9% unemployment and rental rates are up 4%-5% year-over-year with occupancy hovering around 95% across the state.

- Nationally, the new multifamily developments have focused on highly amentitized and A+ apartment units which has drastically affected the rental rates in “renter-by choice” segments while “renter-by-necessity” segments have seen resilience.

- Locally, Iowa has always been a state more focused on servicing a resident’s major needs VS wants and we have seen new developments focused on price-conscious residents thrive compared to the higher amentitized multifamily developments.

How Do You Profit?

What are Some Trends Nationally?

- Buying or Acquiring?

- Overall we are seeing the economy getting back on-track and we anticipate price growth as well as rental growth going forward for many multifamily owners; NOW is the time to get back to active purchasing as we predict prices to grow another 20% over the next 3-5 years in the Iowa market!

- Holding or Refinancing?

- While values continue to go up, be cautious of raising your rents too fast on residents as they are feeling the squeeze of inflation and you may price many residents out of the market.

- Furthermore, while rents should continue to go up, Net-operating incomes should remain flat over the next few years in the face of the last 24-months of higher expenses in labor, insurance, interest rates, etc.

- Selling or Disposing?

- It is our belief that values and prices will continue to rise across Iowa over the next 3-5 years HOWEVER, Net-incomes will remain flat, be open to off-market offers, transactions, etc. as a way to capitalize on a strong price and mitigate flat netincomes.

What have we been Selling and LYSTing JUST in 2024??

SOLD

1600 3rd Ave, Cedar Rapids IA

SOLD

7511 Dennis Dr, Urbandale IA

SOLD

Valley Junction SFR Portfolio, IA

(46 Units)

SOLD

2705 SW 9th St, Des Moines IA

ACTIVE

4719 Toronto St, Ames IA

ACTIVE

W. Steenhoek St, Prairie City IA

ACTIVE

2101 University Ave, Des Moines IA

ACTIVE

125 NW Aurora Ave, Des Moines IA

For more information on Listed, Sold, or Sale Pending properties please contact me! Thank you.

Dislcaimer

Provider is a licensed real estate agent and has the rights to sell real estate in the state of Iowa.

All information was obtained via 3rd parties including but not limited to Yardi Matrix, Iowa-Leading Economic Indicators, CoStar, and more. All effort

was made to ensure the accuracy, timeliness, and completeness of information provided for publication. KW Commercial does not guarantee, warrant,

or represent that all information is accurate or complete and is not liable for any loss, claim, or demand arising from the direct or indirect use or

reliance upon information provided.

Behind the Desk

Jared’s Mother and Father who each respectively participated in Residential and Commercial investment, ownership, and development. At the age of 18 Jared began his own individual investment career by purchasing his first investment property. Within 6 years he built an investment portfolio of over 72 doors spread around Central Iowa over 30+ properties. Frustrated with Residential properties Jared began his career as a commercial real estate agent and made a commitment to help other owners and investors like himself by providing better services, data, communication, and life-experience than traditional agents who marketed themselves as “Investor-Agents.”