Thoughts From Jared

“If you were to look at a picture of me standing at the top of Mt. Kilimanjaro you would think I was on top of the world (or at least the top of Africa). The reality was, while I was smiling on the outside, internally I was dying and in huge pain. What does this have to do with commercial real estate; in a word, everything…

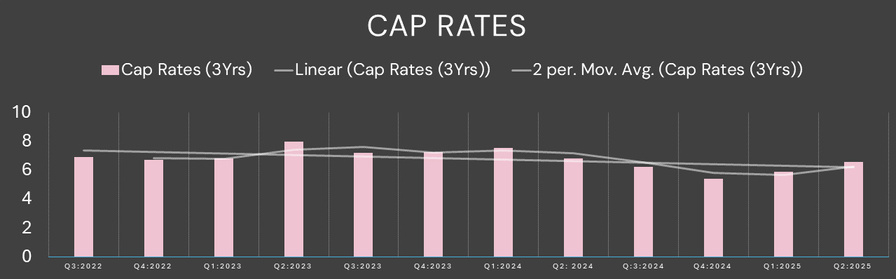

Many times we look at prices, cap rates, etc. and we say to ourselves, “See, THAT is the market!” while the reality is very much different; as my old coach said to me once, “A Cap rate is just a picture of the last 12-months, it’s not a true story of the property (market).” To really understand the market and a property we have to know the story, the home-video of what is really going on…

While it appears that deals are getting done, prices are remaining stable, and overall things appear “rosy” for Iowa multifamily/apartment investors, the reality is that many people are still struggling. Owners are facing higher interest rates, elevated insurance premiums, and lower rental growth while residents are facing rental rates that are squeezing their savings and bank accounts… all while WWIII looms (at least according to the media)…

Is it the end of the world? Absolutely not!

Nothing is ever as bad as it seems, and at the same time, nothing is ever as good as it seems either…

In statistics there is a term called “Regressions to the mean” which ultimately means that things always come back to the average (or neutral) and it appears that over the last couple of years we have been in that regression following the wild ride of COVID-19! With that being said, are things getting better or worse…

Ultimately, I don’t know… I am just someone who follows the statistics and history…

One thing I do know is that just like climbing a mountain, the summit is only the halfway point; and we’re now halfway through 2025… let’s dive into what the second half of 2025 MAY look like while we try to decipher the home-video of the past 3-6 months…

Let’s go!

Executive Summary

What Does this Report Say in Less than 3-Minutes?

Central Iowa Apartment Market Q2-2025 Performance

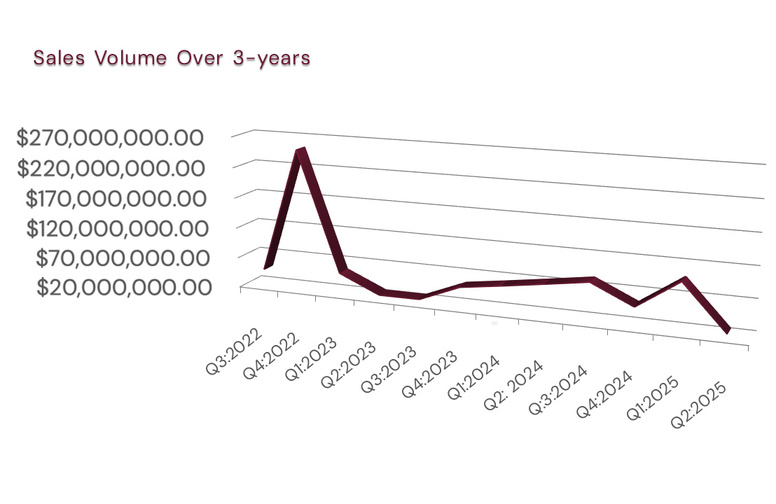

- Sales Volume: $26.05 Million Sales Volume

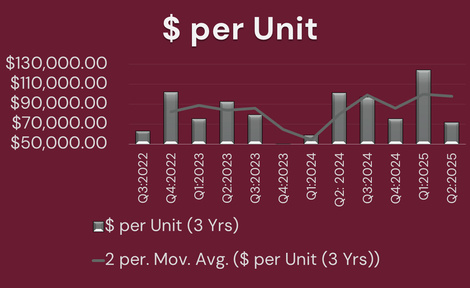

- Price Per Unit: $71,759

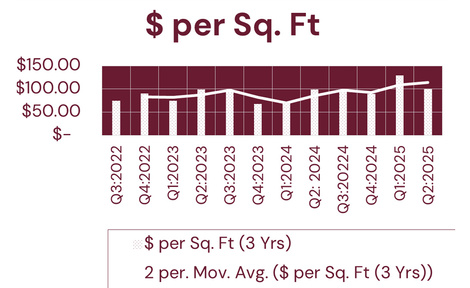

- Price Per Square Foot: $99.64

- Cap Rate: 6.59%

National Multifamily Market Insights

- Occupancy Rate: 94.4% (down slightly year-over-year)

- Rent Growth: Flat nationally, but the Midwest and Northeast continue to outperform other regions.

- Development: A large pipeline of new high-end developments is affecting pricing nationally, but Iowa’s focus on affordable housing continues to perform well.

Three Things to ALWAYS Consider…

- Buying Opportunities

- Local buyers continue to do well and have success with smaller and older assets while the larger assets take longer to sell.

- Holding & Refinancing

- IF the Federal Reserve drops the rate 2x this year, refinancing may be an option; especially with local lenders who are being more aggressive and easier to work with.

- Selling or Disposing

- Sourcing a qualified buyer who can close on a transaction without a re-trade or extension remains the key component in a successful transaction

What Does This Mean for Investors?

- Buyers: The ability to close and provide confidence to sellers is the “Ace up the sleeve” currently.

- Sellers: We have NOT seen a large sale take place this quarter, expect that to change before the end of the year which will drive sales volume to potentially a record year.

The Iowa Market Summarized in Two Sentences…

Larger apartment sales are taking time to materialize which is giving local buyers and sellers the

ability to make deals on a more robust rate and at prices not seen in the last 5-years!

To Deep-Dive MORE INTO THE NUMBERS CONTINUE READING…

Central Iowa Multifamily

How Did Central Iowa’s Apartment Market Perform Last Quarter?

For the 2 Quarter and the Spring market, we saw 17 sales occur over 13 transactions with the average property being of 1966 vintage and consisting of 20 apartment units resulting in $26.05 million of sales volume, an average price per unit of $71,759, an average price per square foot of $99.64, and average cap rate of 6.59% (pro-forma).

What trends did WE identify in the Statistics?

- The average transaction price point was $1.44 million which was the LOWEST average price point seen since the middle of COVID in 2020.

- While there are LARGE deals under contract, it appears they have not closed yet and this is giving local buyers opportunities to purchase.

- 65% of the Buyers originated within Iowa in the 2 quarter; coupled with the lower price points in sales, these statistics align with local confidence in lower price per unit and price per sq. ft. targets.

How will these trends affect?

- Buying or Acquiring?

- With elevated interest rates and larger deals taking time to close, it appears that local buyers with the capability of closing are winning more deals.

- This may signal an opportunity for deals that have “fallen apart” to come back around with 2 or 3 buying groups

- Holding or Refinancing?

- The Federal Reserve has signaled that it will reduce rates twice more this year which should result in effective borrowing rates in the high 5% range or low 6% range; if your rate is coming due in 2026 it may be time to start conversations on a refinance.

- We at The KataLYST Team are hearing that many regional banks remain conservative, local credit unions and banks are ultimately winning most of the business currently.

- Selling of Disposing?

- If you are looking to sell in the next 6-months, the capabilities of the buyer to close and finalize the deal remain the biggest hurdles.

- To discuss a sale OR how to position your property for a sale Please Contact Us!

Iowa Economy

How do we track the Iowa Economy?

So far, the Iowa economy is continuing to look strong with five of the eight indicators showing positive for growth with diesel fuel consumption and manufacturing hours leading the way. Additionally, the USDA is predicting a record year for corn in 2025 which could be good for farmers (however, a strong supply could also hinder prices).

What I’m Watching?

- The Iowa property tax bill pushing through Iowa congress got pushed to the 2026 legislative session. However, multifamily owners should be aware that as of the final edit, new property tax law would REMOVE multifamily as a rollback to residential rates. This could drastically affect pricing of Multifamily while also insulating any tax increases to 3% per year opposed to odd numbered years o reassessment.

What I’m Hearing?

- While pricing continues to appear robust and sellers holdout for their desired profit. I am hearing about mid-range deals that are falling apart in financing or appraisals. Smaller assets under $1 million and large deals over $10 million continue to attract capital and buyers as a safety in our market or in hard assets during inflationary times

What I’m Seeing?

- While it appears that pricing is down this quarter, the ultimate reason is that we have NOT seen a large transaction take place the last 3-months. Over the last 5-years we have continuously see a large $10+ Million transaction or greater dominate the statistics and drive the market…this may change coming into the 3rd and 4th quarter of this year.

National Economy

What is Happening Nationally In the Multifamily Market?

Nationally the multifamily sector is still up 1% which is in-line with where it stood in the Spring of 2025. Additionally, the Northeast and Midwest continue to make up much of the growth while many high growth markets like Denver and Austin face large vacancies and declining rent growth. Nationally occupancy rates are hovering around 94.4%; a level not seen since 2013 which is cause for delayed optimism.

What are Some Trends Nationally?

- Unrest in the Middle East shook the market and tariffs continue to be a concern; however, it appears the commercial real estate market, specifically multifamily, continues to find bright spots in the Midwest and Northeast.

- While interest rates remain high, with rental growth falling off, renting has become cheaper than purchasing in many markets which should help bolster occupancy going forward.

- With building permits lagging, we are still facing 12-36 months of slow construction starts in Multifamily allowing absorption in the A-Class multifamily space.

How do you Profit?

- Buying or Acquiring?

- While deals are getting done, we are seeing them at lower price points. Additionally, we at The KataLYST Team know of a handful of deals facing significant challenges currently meaning that we still have not seen the full extent of this “dip” in the market.

- Holding or Refinancing?

- With rates coming down potentially two more times this year, now may be the time to consider starting the refinance process; local lenders continue to be more aggressive than national and regional banks.

- Selling or Disposing?

- Sales are coming back to life as we push into the second half of the year, if you are considering a sale, securing a qualified buyer is the most important factor currently.

What have WE been Selling and LYSTing JUST in 2025?

SOLD

2101 University Ave, Des Moines IA

SOLD

Triangle Court, Osage IA

SOLD

420 Water St, Center Point IA

SOLD

60-64 Miller Ave SW, Cedar Rapids IA

For more information on Listed, Sold, or Sale Pending properties please contact me! Thank you.

Disclaimer

Provider is a licensed real estate agent and has the rights to sell real estate in the state of Iowa.

All information was obtained via 3rd parties including but not limited to Yardi Matrix, Iowa-Leading Economic Indicators, CoStar, and more. All effort

was made to ensure the accuracy, timeliness, and completeness of information provided for publication. KW Commercial does not guarantee, warrant,

or represent that all information is accurate or complete and is not liable for any loss, claim, or demand arising from the direct or indirect use or

reliance upon information provided.

Behind the Desk

Jared is a 3rd generation real estate entrepreneur growing up with a grandfather who was a homebuilder and investor; a father who was an electrician, developer, and investor; and a mother who was a residential investor, manager, and bookkeeper. With this extensive knowledge as well as being an owner himself for over 15+ years and involved in over 200+ individual transactions he has extensive experience in; financing, operations, management, development, construction, bookkeeping, brokerage, and entrepreneurial activities.

Having helped clients purchase and sell over $100+ Million of real estate personally as an agent-advisor Jared has helped his average client earn over 26.95% rate of return on their real estate investments.

In his spare time has has many hobbies which include but are not limited to: traveling, mountain climbing, hiking, piano, ballroom dancing, Latin dancing, pilot, Spanish lessons, and is always looking for a new adventure.