Thoughts From Jared: An Insight into my Crazy Mind!

“The quality of your life is a direct reflection of the quality of the questions you are asking yourself.”

-Tony Robbins

I was able to meet Mr. Robbins personally in February and have signed up for his Date with Destiny series in November! With that in mind, I thought this quote by him is relevant as it is something I have been working on getting better at over the last 3-4 months and it is something I want to focus on going forward for all of YOU! How can my team and I ask better questions and create better results for all of you? In the market we are in we don’t want to be simply sales agents who ask the question, “What do you want to sell or buy?” A monkey can be taught to ask this question and it is not truly reflective of someone who wants to help YOU achieve higher results in investing in apartments and multifamily around Iowa.

This is our goal at The KataLYST Team, to be coaches, advisors, and partners with you in your investing journey. No matter where you are at, the start, the middle, or the end, going forward our focus is on how we can ask better questions of not only ourselves, but hopefully with YOU! Rather than focusing on buying or selling a commission, questions should be focused on your individual needs and wants, your own plan for creating wealth in, around, and throughout real estate investing.

None of us can control interest rates, the market, or even the election (although we can do our part to vote for our candidate), what we can control is our actions and our understanding of how all of these individual things affect our strategic plan of owning and investing in real estate and it is with this knowledge that our Quarter Report may look and feel different this time opposed to previous copies…in this new and revised Quarterly Iowa Multifamily Market Report you will find a series of questions related to the market and our teams’ thoughts and opinions on these statistics, trends, etc.

Some of these opinions may be wrong, some may be right, some you may agree with, and some you may disagree with, all of these are OK! The best part of the future is that NONE of us know what it holds and as I have often said, “If someone tells you they know what is going to happen they are either 1). Trying to sell you something or 2). Lying to you!” We aren’t for certain our opinions will be right, in fact, they’ll most likely be wrong somehow! However, we want to foster the conversation and ask betters questions so that we can all better prepare for any market, future, or outcome! What will we do if inflation remains high and interest rates continue to remain high for many years? What happens if prices actually go up in-spite of higher interest rates? How do we position ourselves to tackle any of the opportunities that may be coming?

To quote my favorite mentor, “Many of the truths we cling to depend greatly on our own point of view. -Obi-Wan-Kenobi” With the questions in this report, let’s all look at our point of view, let’s ask better questions of ourselves, and let’s make our lives INFINITELY better in doing so!

…Accompany me to Alderann, let’s find our Millennium Falcon, and Let’s Go!

Central Iowa Market

How Did Central Iowa’s Apartment Market Perform Last Quarter?

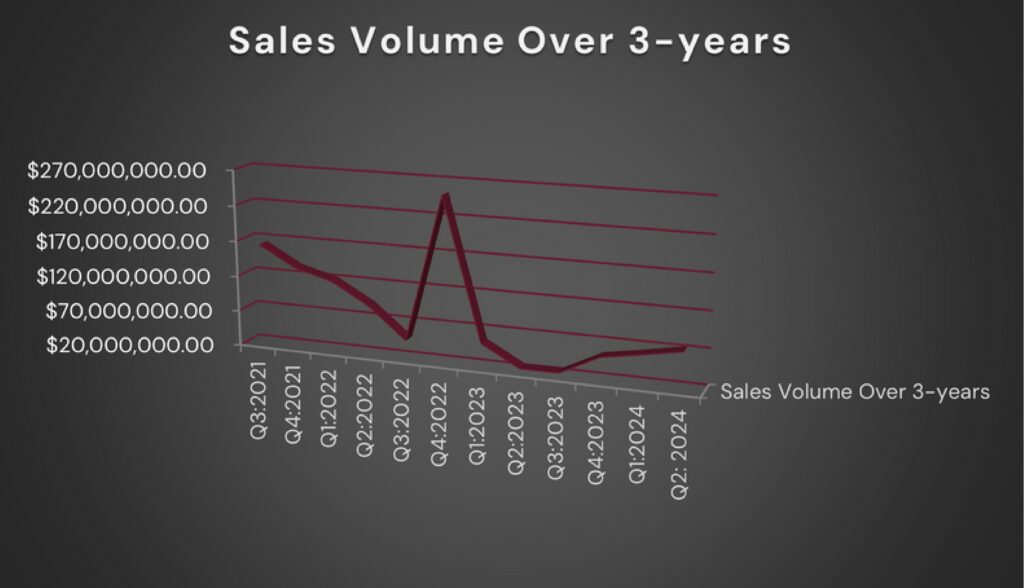

For the 2nd quarter of 2024 we saw 10 sales take place; two large sales were confirmed with no price established (Cityville Apartments and Walnut Lake Apartments). Without confirming these two sales, we are estimating close to $75 million of sales volume, $101,221 price per unit, $99.00 price per square foot, and Cap rates at 7.05%.

What trends did I identify in the Statistics?

- Of the ten sales, seven of them occurred “off-market,” with 2 of the 3 marketed sales being larger and unconfirmed prices.

- The three sales that were marketed took 6-months on average from listing-to-close.

- The “Average” sale was 80 units built in 1972 @ $100,000 price per unit, $99 price per sq. ft, and a 7.05% Cap rate.

How will these trends effect:

- Buying or Acquiring?

- Cap rates continue to remain equal with interest rates which means strong operational experience and maintaining a Strategic Plan on “value-add” operations through increasing income or decreasing expenses is essential.

- To brainstorm “value-add” operations or ideas let our team know and we’ll let you know what we’re seeing around the market being done with success!

- Holding?

- Construction costs remain high and rental rates continue to climb in our market, it appears that pricing continues to remain strong in the face of barriers to competition (new development).

- In the face of inflation we are seeing costs skyrocket (especially in insurance), if you’d like a 2nd opinion or review of your expenses or a referral to a trusted professional contact us!

- Selling or Disposing?

- If you are selling, pricing remains strong, however, it will most likely take longer to sell than previous years so expect 6+ months prior to a closing. It is worth noting that this longer time frame can affect: taxes, 1031 exchanges, repositioning, etc.

- To successfully plan a sale with the highest net-dollar amount and shortest time frame, contact us and we can work on a plan that will help you reach your long-term and short-term goals!

Eastern Iowa Market

How Did Eastern Iowa’s Apartment Market Perform Last Quarter?

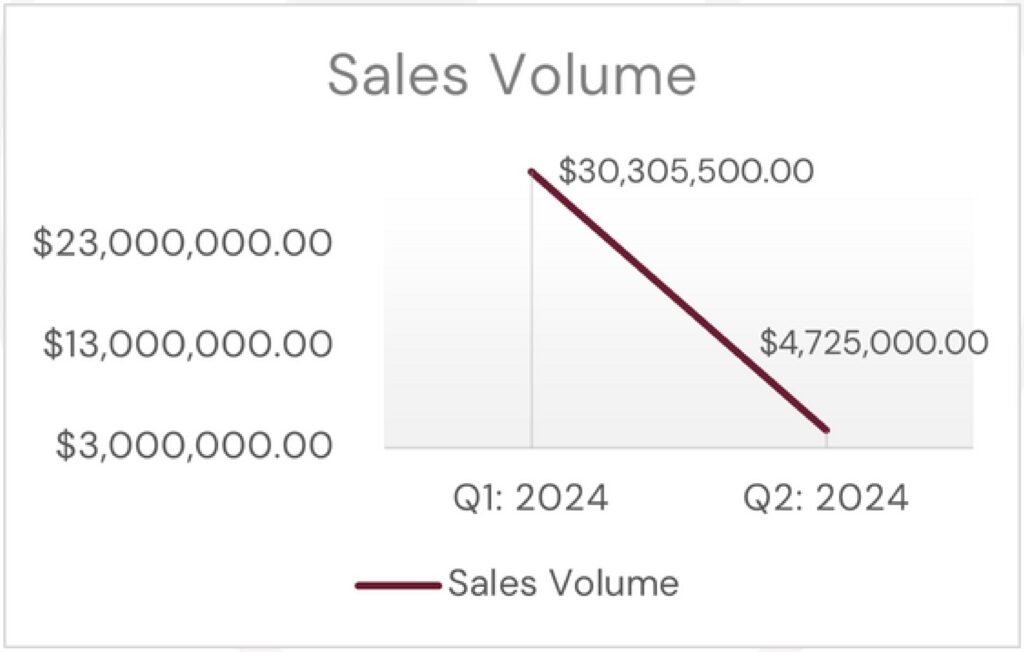

For the 2nd quarter of 2024 we saw 7-sales in Eastern Iowa for a total of $4.7 million of sales volume, $61,363 average price per unit, $74.56 average price per sq. ft, and a 7.33% average Cap rate.

What trends did I identify in the Statistics?

- The price per unit Quarter-to-Quarter jumped slightly while the price per sq. ft. fell, this shows that more 2Bd, 3Bd, and 4Bd units most likely were selling than in the first quarter.

- Sales volume fell off significantly and much smaller properties were sold, this is most likely because larger deals that have come on the market are taking longer to attract buyers and capital.

How will these trends effect:

- Buying and Acquiring?

- Cap rates are slightly better than borrowing costs in Eastern Iowa which signals stronger cash flow.

- In looking at the numbers, the highest sale prices per unit, sq. ft, and cap rates remain in the Iowa City marketplace while pricing outside of this market falls by almost 50%.

- Holding and Refinancing?

- With lower development existing units should continue to remain strong, however, in comparison to home prices for Eastern Iowa, the rental growth will be stagnant and comparable to increases in costs for the seeable future.

- If you are refinancing, we have many banking relationships we can refer you to!

- Selling or Disposing?

- There is still a strong desire to purchase cash flowing assets in Eastern Iowa and so sale prices should remain strong; however, larger assets are flooding the market right now in Eastern Iowa and will take longer to sell than smaller apartment buildings.

- To prepare for a sale, there are certain things you can do 3-6 months out to facilitate a faster sale, a higher price, and an easier sale, reach out to us if this sounds like something you’d like to learn about!

Iowa Economy

How do we track the Iowa Economy?

The “Leading Economic Indicators Index” is something that tracks 8-different things that affect an economy for growth and can signal market cycles. Overall they track:

- Agricultural Profit

- Manufacturing Hours

- Unemployment

- Diesel Fuel Consumption

- Iowa Stock Market

- Yield Spread (Interest Rates)

- New Orders (New Business)

- Residential Building Permits

What does this all mean?

The Iowa economy is overall remaining stable with annualized growth of 0%.

Which are the most important for real estate?

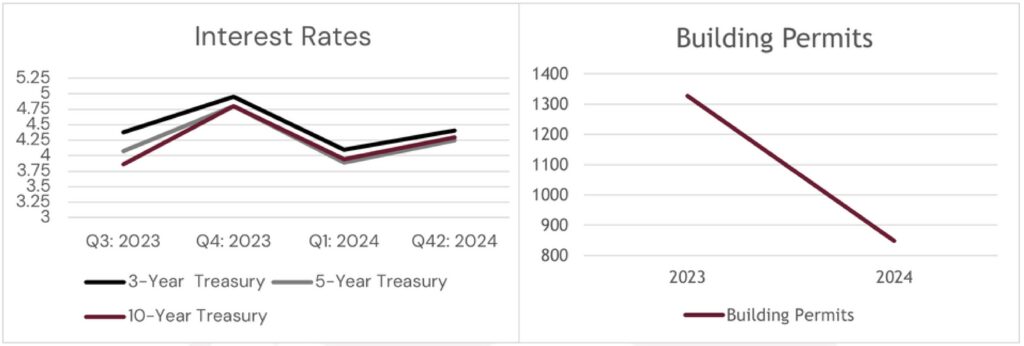

- Yield Spread (Interest Rates) have remained “inverted” for 19-months now. This means that short-term interest rates are higher than long-term. In normal times, investors would want a higher return the longer the debt is held, the inversion shows that investors see “risk” in the short term and thereby want a higher return on their debt for the added risk. An inverted yield curve has almost always signaled a recession in the US economy.

- Residential Building Permits for Iowa were 849 in May down from 1,327 in May last year. This signals a 36% decrease year-over-year in new building permits.

What Do I see in These Statistics?

- While interest rates are “inverted” they have been moving in lock-step the last year which means that there have been no significant changes in banks and the Federal Reserves view of risk over the last year. If we were to see the lines constantly crossing each other as we saw earlier in 2023 and in 2022 it would signal risks and uncertainty in the marketplace.

- If you’re curious about factors I am watching in the Iowa economy, reach out and we can discuss potential good and bad economic factors!

- The lack of building development signals that current ownership groups should feel calm with the lack of new supply being built to challenge existing apartment units. Furthermore, with the high costs of construction, this potentially is a good signal that we will continue to see price growth in apartments as demand for housing remains strong in Iowa while new supply is significantly slowing down.

- A bold prediction; with the higher costs of construction and what I am seeing as other factors in the Iowa economy, I predict we will continue to see sale prices and property values rise in the face of inflation! Reach out to me and I’ll happily explain why I see this potentially happening!

National Economy

What is Happening Nationally In the Multifamily Market?

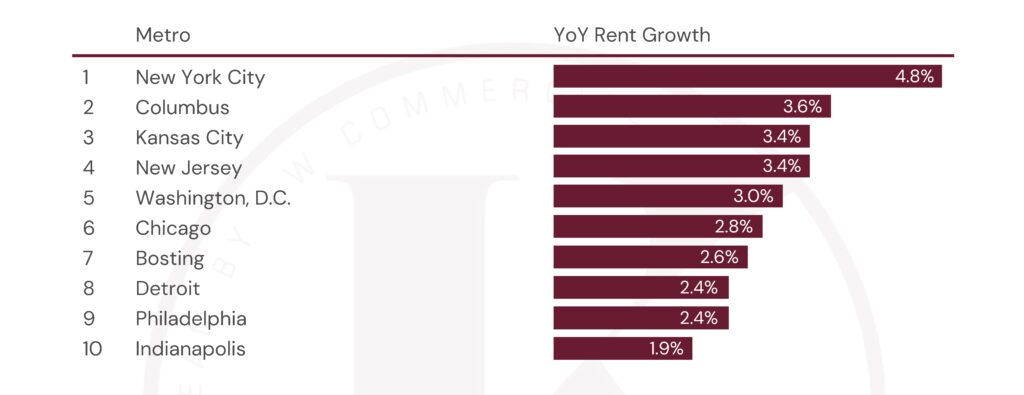

Nationally the multifamily sector is going through changes, investment sales activity is at $19.3 billion and down 24% year-over-year and rental growth remains flat at 1.0% year-to-date. High supply levels continue to hinder rent growth, especially in the South and Southeast; while the Northeast and Midwest continue to do well.

What are Some Trends Nationally?

- The Single-Family Rental market is up 1.4% for year-to-date rent which is surpassing Multifamily apartments. With high costs of construction, higher interest, rates, and Millennials beginning to move to suburbs we see this trend continuing.

- Locally, we are seeing many Multifamily and Apartment owners sell to capture the equity they’ve gained in their property and invest in SFR which is seeing higher rents, more appreciation, and is easier to manage on an individual basis. This coincides with the National trend.

- Property prices and values in HOT markets continue to fall which is causing challenges to sales, refinances, and values.

- Locally, we are uncertain if this trend will make its way to Iowa as we are still seeing active buyers and strong pricing; however, sales are taking longer than previous years due to challenges in finding and acquiring capital both from banks and investors.

What are Some Trends Nationally?

- Buying or Acquiring?

- In comparing sales prices of $99.00 per sq. ft. compared to rebuild costs of $200+ (a 50% value) I predict that pricing will continue to rise over the next 3-5 years until we see a leveling of Existing VS New Construction; overall we could see pricing jump another 20%-30%.

- With capital and money being harder to find, cash or strong balance sheets will continue to stand out when making offers.

- Holding and Refinancing?

- Rental rates should continue to be strong and I am seeing, and predicting, a continual 4% increase annually in Iowa over the next 3-5 years.

- While rents are rising aggressively, they are still not rising at the pace of labor, insurance, interest rates, etc. and so Net-Profits may actually decline over the next 3-5 years; operational experience will be a winner going forward.

- Selling or Disposing?

- Prices continue to be strong which means sales can still take place in the face of higher interest rates and a slowing economy; however, they are taking longer due to lack of money and capital.

- With Net-incomes falling and banks limiting deals, actual Profit & Loss statements and NOT Pro-Formas will be essential in a strong price being obtained.

What have we been Selling and LYSTing JUST in 2024??

1600 3RD AVE, CEDAR RAPIDS, IA

VALLEY JUNCTION SFR PORTFOLIO, IA (46-UNITS)

For more information on Listed, Sold, or Sale Pending properties please contact me! Thank you.

Disclaimer

Provider is a licensed real estate agent and has the rights to sell real estate in the state of Iowa.All information was obtained via 3rd parties including but not limited to Yardi Matrix, Iowa-Leading Economic Indicators, CoStar, and more. All effort was made to ensure the accuracy, timeliness, and completeness of information provided for publication. KW Commercial does not guarantee, warrant, or represent that all information is accurate or complete and is not liable for any loss, claim, or demand arising from the direct or indirect use or reliance upon information provided.

Behind the Desk

Jared’s Mother and Father who each respectively participated in Residential and Commercial investment, ownership, and development. At the age of 18 Jared began his own individual investment career by purchasing his first investment property. Within 6 years he built an investment portfolio of over 72 doors spread around Central Iowa over 30+ properties. Frustrated with Residential properties Jared began his career as a commercial real estate agent and made a commitment to help other owners and investors like himself by providing better services, data, communication, and life-experience than traditional agents who marketed themselves as “Investor-Agents.”

Heather came to us from working as a strategic analyst for a well-known annuity company in Urbandale. She has a love for numbers and fine-tuning systems. When Heather is not working, she can be found on any day running one of her 4 children to one of their many activities, or volunteering around her hometown of Panora. She enjoys spending time on their farm with all her animals…with chickens being her favorite. The one time city girl, has really adapted to the quiet, country life, and wouldn’t have it any other way.