Thoughts From Jared

“Sometimes the best deal you do, is the one you don’t do.” That was advice given to me by one of my mentors nearly a decade ago, and I’ve never forgotten it. As we head deeper into 2025, I get the sense it’s advice some investors haven’t yet learned—but are about to. To say this market is “bumpy” would be an understatement…

Tariffs, political change, and global uncertainty are rattling through the economy—affecting everything from construction costs to interest rates. And just like the broader economy, commercial real estate in Iowa is on its own roller coaster ride…

On one side, we’re seeing large multifamily deals trading at eye-popping prices, attracting serious interest from national and even international buyers (yes—international capital is starting to circle Iowa, if the rumors are true). On the other side, smaller assets are dragging the market down as banks and appraisers apply more pressure—lower valuations, stricter lending, and less tolerance for optimistic projections…

Pro-formas are out. Cash flow is back…

Many of the listings we’re seeing today were purchased during the 2020–2022 peak. Now, as debt matures, capital calls are triggered, and business plans fall short of their targets, we’re entering a phase of forced sales—if buyers can make the numbers work…

Real estate is cyclical. So is the economy. But the big question today: Are we in a down market, a flat market, or the early stages of something new?

With volatility in the stock and bond markets, some buyers may still find stability in commercial real estate, which could flatten—or even lift—the market in certain pockets across Iowa. As always, only time will tell.

My advice? Stick to your numbers. Underwrite conservatively. Listen to your lender— and your appraiser. They may be protecting you. Work with agents who advise you, not just try to sell you.

Because in markets like this, prudence beats aggression—and sometimes, the best deal you do… is the one you don’t do…

Now, let’s dive into what the numbers say and see where this roller coaster is headed next…

Executive Summary

What Does this Report Say in Less than 3-Minutes?

Central Iowa Apartment Market Q1-2025 Performance

- Sales Volume: $69.7 Million Sales Volume

- Price Per Unit: $124,269

- Price Per Square Foot: $128.98

- Cap Rate: 5.91%

Eastern Iowa Apartment Market Q1-2025 Performance

- Sales Volume: $47.8 Million Sales Volume

- Price Per Unit: $184,594

- Price Per Square Foot: $302.78

- Cap Rate: 6.21%

National Multifamily Market Insights

- Occupancy Rate: 94.7% (steady year-over-year)

- Rent Growth: Flat nationally, but the Midwest and Northeast continue to outperform other regions.

- Development: A large pipeline of new high-end developments is affecting pricing nationally, but Iowa’s focus on affordable housing continues to perform well.

Three Things to ALWAYS Consider…

- Buying Opportunities

- Central Iowa’s has seen a TON of new listings hit the market; underwrite accordingly!

- Eastern Iowa continues to be a place for VALUE investors to find deals and does NOT attract national and international buyers.

- Holding & Refinancing

- With REAL borrowing costs remaining high, now is NOT the time to refinance.

- Selling or Disposing

- The Iowa Market is at a turning point and it REMAINS to be seen if it will continue to go up, down, or sideways; we recommend caution on selling unless it aligns with your overall strategies.

What Does This Mean for Investors?

- Buyers: Most of the best opportunities right now with higher cap rates are coming from “off-market” deals.

- Sellers: Larger and newer multifamily complexes are driving HUGE demand from out-ofstate

- capital.

The Iowa Market Summarized in Two Sentences…

Des Moines has recently been named the fastest growing metro in the Midwest which is attracting large investors to larger (and newer deals). The stability and growth of our market continues to be a story investors like while the Eastern Iowa market place continues to offer value for local buying groups.

Central Iowa Multifamily

How Did Central Iowa’s Apartment Market Perform Last Quarter?

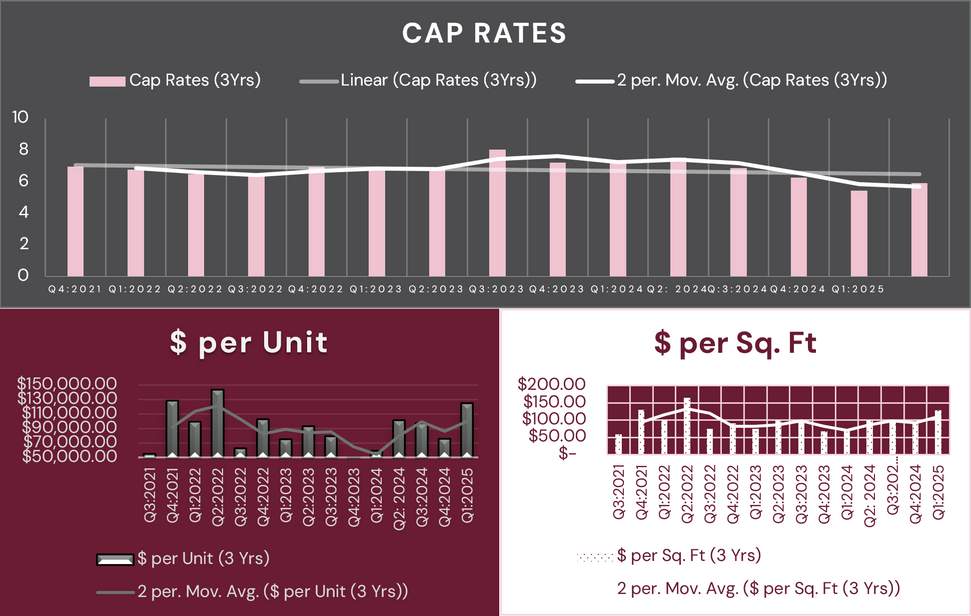

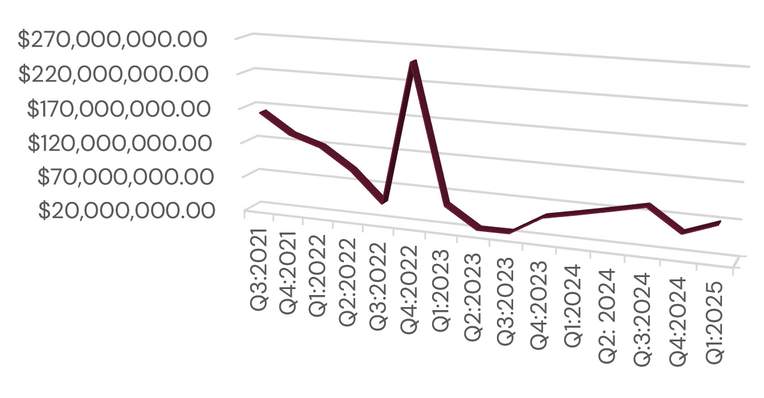

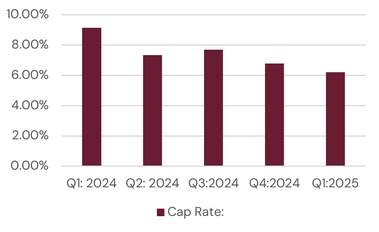

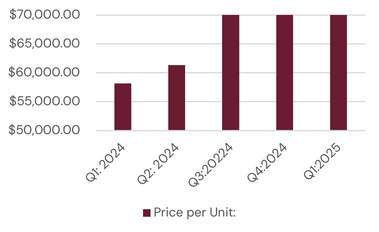

For the 1 Quarter and start of the year we saw 15 sales occur over 12 transactions with the average property being of 1982 vintage and consisting of 37 apartment units resulting in $69.7 million of sales volume, an average price per unit of $124,269, an average price per square foot of $128.98, and average cap rate of 5.91% (actual).

What trends did WE identify in the Statistics?

- The average AGE of property has increased significantly; most likely due to complications in insurance premiums for buyers.

- With newer Vintage properties selling, the price per unit and price per sq. ft. are UP drastically.

- Of the $69.7 Million sales volume, one LARGE sale dominated with a sale price of $38 Million (54%). In other words, smaller transactions were the “Normal” while large sales remain slow-moving.

How will these trends affect?

- Buying or Acquiring?

- Competition with “Out-of-Market” ownership groups remain strong especially in newer and larger assets.

- In the first quarter we’ve seen over 27 NEW listings hit the market surpassing sales and shifting the market slightly in a Buyer’s Favor.

- Holding or Refinancing?

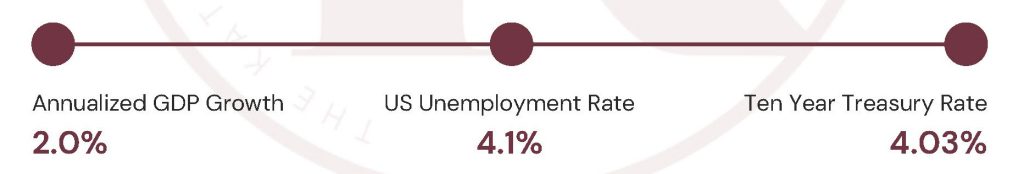

- The 10-year treasury continues a roller-coaster ride in the face of tariffs and uncertainty in the market while many banks continue to extend non-performing assets.

- Not all banks are created equal; to find out who is still lending reach out to us here at The KataLYST Team.

- Selling of Disposing?

- If you are looking to sell; ensure that your property is properly positioned in TODAY’s market and against the competition.

- If you are looking to sell; ensure it is for the right reasons that match your strategy and help you get to your long-term goals.

- To talk about how to position your property OR your long-term strategy we can help here at The KataLYST Team.

Sales Volume Over 3-Years

Eastern Iowa Multifamily

How Did Eastern Iowa’s Apartment Market Perform Last Quarter?

For the 1 quarter of 2025 we saw 7 sales in Eastern Iowa for a total of $47.8 million of sales volume, $184,594 average price per unit, $302.78 average price per sq. ft, and a 6.21% average Cap rate.

What trends did WE identify in the Statistics?

- These statistics are SLIGHTLY misleading with two of the sales making up for 89% of the sales volume and market.

- The two larger sales were newly built construction and DRASTICALLY drove up the prices, lowered the cap rates, and affected the sales volume.

- When taken out, 4 sales accumulated $4.8 million with average prices at $59,000 per unit.

How will these trends effect:

- Buying or Acquiring?

- Eastern Iowa has seen less transaction activity than Central Iowa making it an opportunity for value-driven investors.

- To hear about upcoming listings or deal flow contact our team!

- Holding or Refinancing?

- Many smaller credit unions seem to be expanding into commercial real estate that were NOT active a few years ago; these options could be perfect for a refinancing investor.

- If you are considering holding, prices should continue to rise in the foreseeable future in Eastern Iowa; however, be cautious of higher expenses and inflation reducing your net-profitability.

- Selling or Disposing?

- Prices when looked at the average are in equilibrium over the last year in Eastern Iowa local buyers continue to find value in multifamily apartments.

- If you are looking to sell in the Summer, NOW is the time to begin preparing your property for sale; contact our team to see how you can position your property for the MOST profit!

Iowa Economy

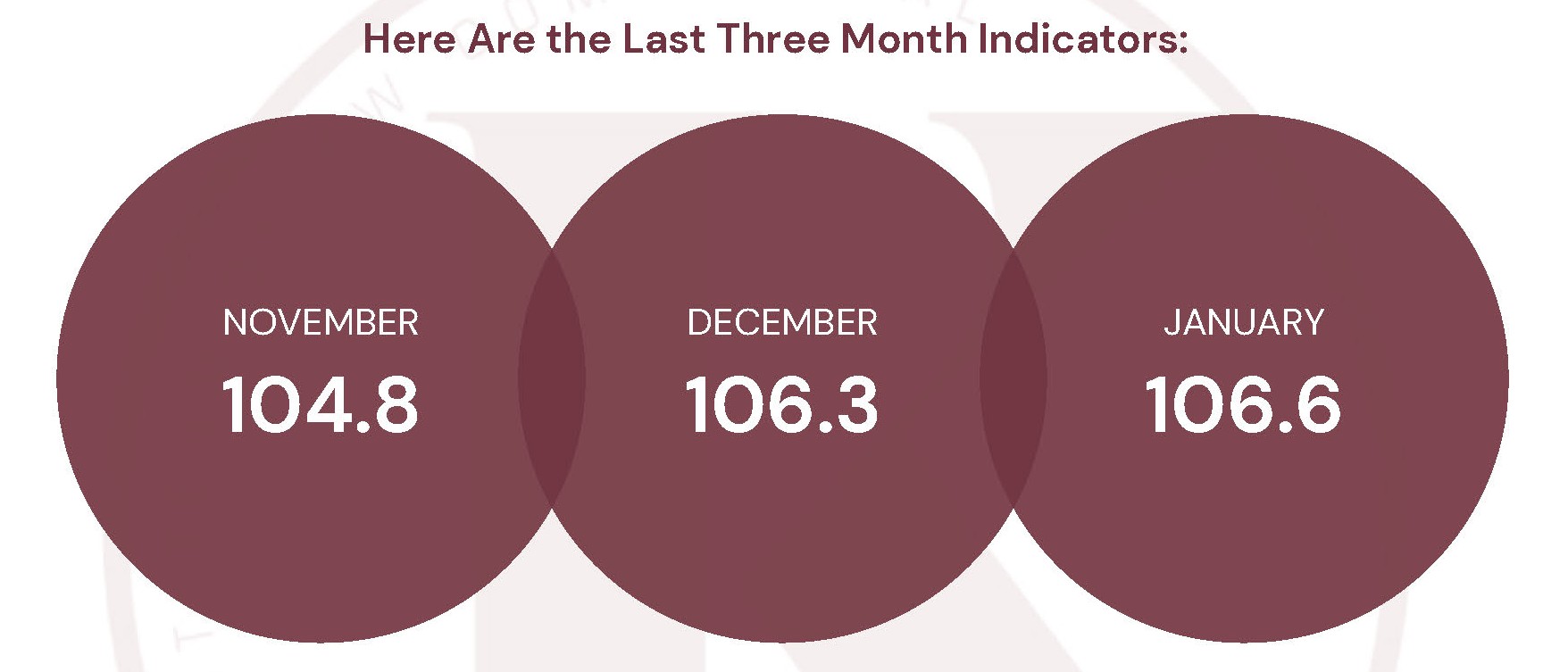

How do we track the Iowa Economy?

As 2025 kicks off, it appears that the Iowa economy is on-track for a year of growth that is annualized over 3.3% with five of the eight indicators signaling growth in the Iowa economy (Manufacturing Hours, Diesel Fuel Consumption, Stock Market, Yield Spread, and Building Permits). However, worth noting is that while the leading indicators are showing growth in the economy, they are also BEHIND the current writing of this and due to tariffs, the national stock market, and other economic factors, a change in these metrics MAY be closer than appears.

What I’m Watching?

- Iowa Property Taxes are going through the Iowa Congress right now and currently the bill stands at a 2% Cap in property taxes annually. However, many cities are pushing back on this in the face of new construction and TIF districts. Currently it appears the 2% cap will hold-up and should be a small blessing for multifamily owners.

What I’m Hearing?

- While we are seeing strong prices, cap rates, etc. I am hearing from many buyers and borrowers’ are facing challenges in the financing and appraisal markets with MANY appraisals coming in lower than the offer price while banks are underwriting SOLEY on actual financials and not pro-forma’s.

- The market is seeing a shift from “Growth” and appreciation to “Value” and cashflow it appears.

What I’m Seeing?

- So far, throughout all of Iowa we have seen over 50+ new apartment listings hit the market with only 12-16 transactions.With this in mind, it appears to be a “Buyer’s Market” for anyone who is in the Multifamily investment space; especially in the smaller multifamily space where National and Institutional buyers are NOT making offers.

National Economy

What is Happening Nationally in the Multifamily Market?

Nationally the multifamily sector is up 1% year-over-year in rental growth; however, worth noting is that all of this rental growth has come from the Northeast and Midwest markets where new supply has been limited while the South and Southeast markets continue to see declines in occupancy and rent growth.

What are Some Trends Nationally?

- Tariffs continue to affect the construction market, coupled with the recent supply that was some of the largest number of new construction units in history, new unit deliveries will slow.

- New units continue to pull from the B and C class multifamily apartment complexes as developers look to bolster their occupancy numbers.

- Single-Family and Build-to-rent continue to attract interest in the face of higher interest rates making it more challenging for new home-buyers. However, construction costs are also hindering this segment of the industry and rents remain flat year-over-year.

How do you Profit?

- Buying or Acquiring?

- Be FIRM on your underwriting, banks and appraisals are making the closing process challenging; we predict many deals will NOT close and come “back-around!”

- Holding or Refinancing?

- “Survive to 25” is here and many banks continue to extend borrowers hoping for better rates in 2026.

- Selling or Disposing?

- Now is NOT the time to be selling unless it directly fits into your long-term goals and strategies (in our opinion). Selling to transition to newer or bigger assets can be one great reason to sell currently with the amount of new inventory being listed. If you are selling, ensure you are properly positioning your property against the competition.

What have WE been Selling and LYSTing JUST in 2025?

SOLD

2101 University Ave, Des Moines IA

SOLD

Triangle Court, Osage IA

SOLD

420 Water St, Center Point IA

For more information on Listed, Sold, or Sale Pending properties please contact me! Thank you.

Disclaimer

Provider is a licensed real estate agent and has the rights to sell real estate in the state of Iowa.

All information was obtained via 3rd parties including but not limited to Yardi Matrix, Iowa-Leading Economic Indicators, CoStar, and more. All effort

was made to ensure the accuracy, timeliness, and completeness of information provided for publication. KW Commercial does not guarantee, warrant,

or represent that all information is accurate or complete and is not liable for any loss, claim, or demand arising from the direct or indirect use or

reliance upon information provided.

Behind the Desk

Jared is a 3rd generation real estate entrepreneur growing up with a grandfather who was a homebuilder and investor; a father who was an electrician, developer, and investor; and a mother who was a residential investor, manager, and bookkeeper. With this extensive knowledge as well as being an owner himself for over 15+ years and involved in over 200+ individual transactions he has extensive experience in; financing, operations, management, development, construction, bookkeeping, brokerage, and entrepreneurial activities.

Having helped clients purchase and sell over $100+ Million of real estate personally as an agent-advisor Jared has helped his average client earn over 26.95% rate of return on their real estate investments.

In his spare time has has many hobbies which include but are not limited to: traveling, mountain climbing, hiking, piano, ballroom dancing, Latin dancing, pilot, Spanish lessons, and is always looking for a new adventure.